Indian equity markets staged a strong comeback on Monday, September 29, 2025, with the BSE Sensex gaining 245.67 points to close at 84,928.61 and the NSE Nifty50 reclaiming the crucial 25,800 level to settle at 25,827.05. The rebound came after three consecutive sessions of decline, driven primarily by renewed foreign institutional investor (FII) buying and positive global cues that helped restore confidence among domestic investors. The recovery was broad-based, with 28 of the 30 Sensex components ending in positive territory, signaling a shift in market sentiment after recent volatility.

The benchmark indices opened on a positive note and maintained their upward trajectory throughout the trading session, with the Sensex touching an intraday high of 85,012.45 and the Nifty reaching 25,851.20. The Sensex closed 0.29% higher while the Nifty gained 0.33%, marking their best single-day performance in over a week. Market breadth remained positive with 1,847 stocks advancing against 1,203 decliners on the BSE, while 182 stocks hit their 52-week highs compared to 94 touching new lows. The India VIX, the volatility gauge, declined by 3.2% to 13.45, indicating reduced fear among market participants.

The market rebound was primarily attributed to the return of foreign institutional investors who had been net sellers for the past several sessions. FIIs turned net buyers with inflows of ₹1,847 crore in the cash segment, while domestic institutional investors (DIIs) remained net buyers with purchases worth ₹942 crore, according to provisional exchange data. Additionally, easing concerns over global interest rates and stabilizing crude oil prices below $85 per barrel provided positive sentiment. The rupee’s strengthening to 83.12 against the dollar also supported market sentiment, making Indian equities more attractive to foreign investors.

Top Gainers of the Day:

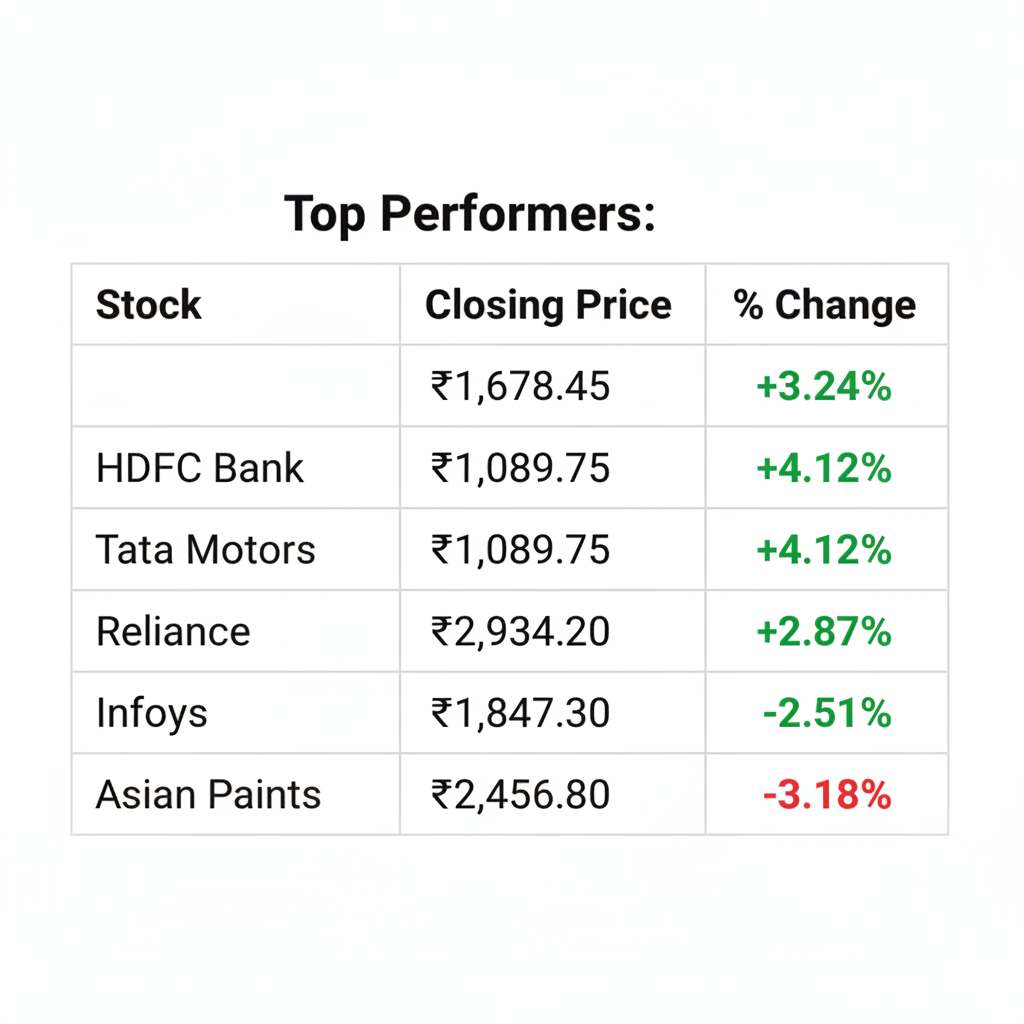

HDFC Bank emerged as the biggest gainer among Sensex components, surging 3.24% to ₹1,678.45 on expectations of strong net interest income (NII) growth in Q2FY26 results. Reliance Industries gained 2.87% to ₹2,934.20 following news of a strategic partnership between Jio Platforms and a global technology major. Infosys climbed 2.51% to ₹1,847.30 as the dollar’s strength against emerging market currencies boosted prospects for IT exporters. Tata Motors rallied 4.12% to ₹1,089.75 on robust September auto sales data and strong export order bookings for its commercial vehicle segment.

Top Losers of the Day:

Despite the overall positive sentiment, some heavyweight stocks faced selling pressure. ITC declined 2.34% to ₹487.20 amid concerns over cigarette volume growth and regulatory uncertainty. Asian Paints dropped 3.18% to ₹2,456.80 following management commentary on rural demand slowdown affecting the decorative paints segment. Bajaj Finance fell 1.87% to ₹7,234.15 after the Reserve Bank of India issued fresh guidelines on unsecured personal loans. State Bank of India slipped 1.65% to ₹821.45 despite reporting strong credit growth numbers, as investors remained concerned about net interest margin pressure.

Sectoral performance showed a mixed trend with IT and banking sectors leading the gains. The Nifty IT index surged 2.1% as dollar strength and improved sentiment around technology spending boosted major players including TCS, Wipro, and HCL Technologies. The Nifty Bank index gained 1.4% with private sector banks outperforming their public sector counterparts. Auto stocks also performed well with the Nifty Auto index rising 1.8% on festive season demand expectations. However, FMCG and pharma sectors remained under pressure, declining 0.8% and 0.4% respectively, as concerns over rural consumption and regulatory issues persisted.

Foreign institutional investors returned as net buyers after four consecutive sessions of selling, purchasing equities worth ₹1,847 crore in the cash segment. This marked a significant shift from the previous week when FIIs had net sold over ₹3,200 crore, contributing to market weakness. Domestic institutional investors continued their buying streak with net purchases of ₹942 crore, maintaining their role as market stabilizers. The combined institutional buying of nearly ₹2,800 crore provided strong support to the indices and helped counter retail profit-booking at higher levels.

Global markets provided a supportive backdrop with Asian equities closing higher led by gains in Chinese and Japanese markets. The Dow Jones and S&P 500 had closed marginally positive on Friday, while European markets showed resilience amid ongoing geopolitical concerns. Crude oil prices stabilized below $85 per barrel, easing inflationary concerns and benefiting oil marketing companies and aviation stocks. The dollar index retreated from recent highs, providing relief to emerging market currencies including the rupee.

From a technical perspective, the Nifty’s reclaim of the 25,800 level is encouraging for bulls, with immediate resistance now at 25,880 and strong resistance at 26,000. On the downside, support remains intact at 25,650 with crucial support at 25,500. The Sensex faces resistance at 85,200 and strong resistance at 85,800, while support lies at 84,400 and major support at 83,800. The technical indicators suggest that the recent correction may have found a bottom, but sustained buying above current levels is needed for a meaningful recovery.

Quick Investor Checklist:

- Monitor FII flow trends as sustained buying is crucial for market direction

- Track global cues including US Fed policy signals and China’s economic data

- Watch Q2FY26 earnings season starting October for sector-specific triggers

Market analysts remain cautiously optimistic about the near-term outlook, citing the return of FII buying and stabilizing global conditions. “The market’s ability to hold above key support levels and the resumption of foreign buying suggests that the worst of the correction may be behind us,” noted a senior strategist at a leading brokerage firm. However, experts advise caution as global uncertainties persist and the upcoming earnings season will be crucial for sustaining the momentum.

Retail Watch: Small investors should avoid the temptation to chase today’s rally and instead focus on accumulating quality stocks during market dips. The current rebound provides an opportunity to book profits on momentum plays while building positions in fundamentally strong companies. Maintain proper risk management and avoid leveraged positions as market volatility is expected to continue in the near term.

The day’s rebound provides hope that Indian markets may have found stability after recent turbulence, but investors should remain watchful of global developments and domestic earnings outcomes. While the return of FII buying is encouraging, sustained recovery will depend on continued institutional support and positive earnings growth. The market’s resilience above key support levels suggests that long-term investors can remain constructive while maintaining appropriate position sizing and risk management protocols.