Indian benchmark indices extended their losing streak for a seventh consecutive session on September 26, 2025, with the Sensex crashing 733 points and the Nifty falling below the critical 24,700 level amid growing concerns over US tariff policies and persistent investor caution.

The BSE Sensex closed 733.22 points lower at 80,426.46, marking a 0.90% decline, while the NSE Nifty dropped 236.15 points to settle at 24,654.70, down 0.95% from the previous close. The Sensex traded in a range between a day low of 80,332.41 and a high of 81,033.09, opening at 80,956.01 before succumbing to selling pressure throughout the trading session. This marks the indices’ worst performing streak in recent months, with the Nifty now trading significantly below its 50-day moving average of 24,875.8.

The primary driver behind today’s market decline was US President Donald Trump’s announcement of a 100% tariff on branded and patented pharmaceutical products entering the country, effective October 1, 2025. Trump clarified on his Truth Social platform that companies would be exempt from these tariffs only if they are “breaking ground” or have manufacturing plants “under construction” in America. Additional tariff announcements included a 25% duty on heavy trucks and 50% levy on kitchen cabinets and associated products, creating widespread uncertainty across multiple sectors.

Sectoral performance reflected broad-based weakness, with all major indices closing in negative territory. The pharmaceutical sector bore the brunt of the selling pressure following the tariff announcement, while IT stocks faced additional headwinds from weak guidance by global peers like Accenture. Banking stocks also declined sharply, with capital goods, consumer durables, metals, telecom, and PSU Bank indices all losing 1-2%. The broader market witnessed even steeper losses, with the BSE Midcap index shedding 2.05% and the Smallcap index declining 2.26%, indicating widespread investor pessimism.

Among individual stock movements, IndusInd Bank, Sun Pharma, Mahindra & Mahindra, Eternal Oils, and Tata Steel emerged as the biggest losers on the Nifty. However, some stocks managed to buck the trend, with Larsen & Toubro gaining over 3% after Telangana took over Hyderabad Metro’s ₹2,000 crore debt, while Tata Motors, Eicher Motors, Reliance Industries, and ITC also posted gains. Over 100 stocks hit their 52-week lows during the session, including major names like TCS, Sun Pharma, and CG Consumer, highlighting the severity of the market correction.

Foreign portfolio investors (FPIs) continued their selling spree, contributing to the market’s downward pressure alongside weak global cues and a depreciating rupee that closed marginally lower at 88.71 per dollar. The persistent FPI outflows, combined with higher US tariffs, visa fee hikes, and ongoing trade concerns, have collectively fueled the market decline over the past week. Domestic institutional investors have been providing some support, but their buying has been insufficient to counter the FPI selling pressure.

Global market sentiment remained subdued, with Asian markets closing lower across the board. The South Korean Kospi fell 2.5%, while Taiwan Weighted declined 1.7%, reflecting broader concerns over trade policies and economic uncertainty. European markets also opened on a weak note, with investors closely monitoring the implications of the latest US tariff announcements on global trade dynamics.

From a technical perspective, the Nifty’s sustained weakness has pushed the index toward its key support level near the 200-day exponential moving average around 24,400. Market analysts note that the index is now approaching critical support levels, with the recent decline accelerated by weakness in heavyweight stocks and persistent selling pressure. The sharp correction in mid and small-cap stocks has further dampened overall market sentiment, creating a challenging environment for investors.

Quick Investor Checklist:

- Tariff Updates: Monitor developments on US trade policies and their potential impact on Indian pharmaceutical and IT sectors

- FPI Flow Tracking: Watch foreign investor activity as continued outflows could pressure markets further

- Technical Levels: Keep an eye on Nifty’s 24,400 support level, which could determine near-term market direction

- Global Cues: Track Asian and US market movements for directional guidance

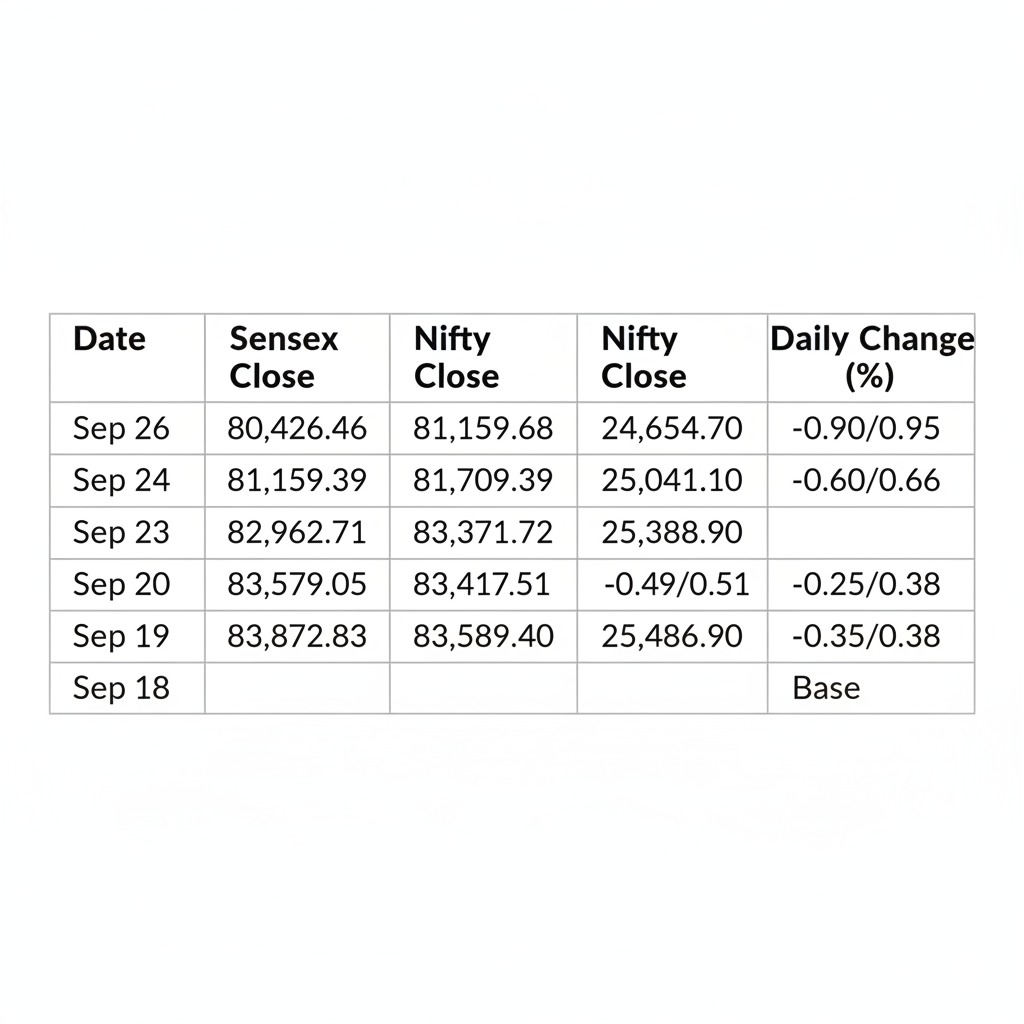

Seven-Day Market Performance:

Retail Watch: Small investors should avoid panic selling during this volatile phase and instead focus on fundamentally strong companies with solid business models. The current correction, while painful, could present opportunities for long-term investors to accumulate quality stocks at attractive valuations. Rather than making hasty decisions based on short-term market movements, retail investors should maintain their investment discipline and consider systematic investment approaches during this uncertain period.

For retail investors and traders, the current market environment presents both challenges and opportunities. While the immediate outlook appears cautious given the tariff concerns and technical weakness, long-term investors with a diversified portfolio of fundamentally sound companies may view this correction as a potential buying opportunity. The key is to avoid leveraged positions and focus on companies with strong balance sheets and sustainable business models that can weather external headwinds.

The extended losing streak reflects a confluence of factors including global trade tensions, currency pressures, and sector-specific challenges in pharmaceuticals and IT. However, India’s underlying economic fundamentals remain intact, with robust domestic consumption, government infrastructure spending, and corporate earnings growth providing medium-term support. The current correction, while extending longer than anticipated, is likely to present attractive entry points for patient investors willing to look beyond near-term volatility and focus on India’s long-term growth trajectory.