Sharp focus on consumer discretionary, auto, and real estate stocks as corporate updates drive pre-market sentiment.

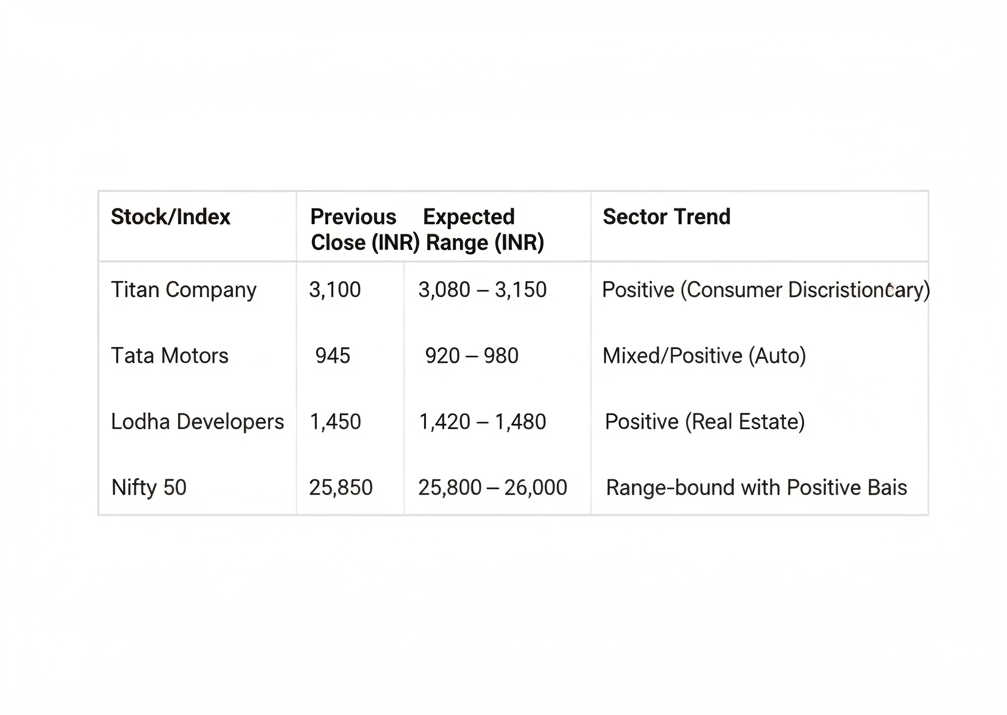

Indian equity markets are poised for a largely firm opening today, following a mixed global sentiment but strong domestic corporate momentum. The pre-market buzz is firmly centred on high-quality stocks with significant quarterly updates or policy tailwinds. Leading the pack of stocks to watch are Titan Company Ltd., Tata Motors Ltd., and Macrotech Developers Ltd. (Lodha Developers). These companies represent three of the most cyclical and consumption-driven sectors in the Indian economy—jewellery/consumer luxury, auto, and real estate—and their performance will act as a barometer for India’s festive and housing season demand. Traders and investors should prepare for sector-specific volatility and opportunity as the opening bell rings.

Overnight trading saw US markets close mixed, with the S&P 500 registering marginal gains and the tech-heavy Nasdaq cooling slightly, primarily due to lingering uncertainty regarding the US Federal Reserve’s future rate trajectory. The overall global risk-on appetite remains subdued, though Asia-Pacific markets are flashing a greener signal this morning, suggesting a modest positive bias for Indian indices. Crude oil prices (Brent) have steadied near the $85 per barrel mark, which is a comfortable level for India’s import bill, while the Indian Rupee is expected to hold a tight range against the US Dollar, absorbing yesterday’s modest Foreign Institutional Investor (FII) outflows.

Domestically, the underlying technical structure of the Nifty 50 and Sensex remains strong, maintaining their positions comfortably above key moving averages. Yesterday’s session saw minor profit booking at higher levels, with FIIs registering a net sell figure, offset largely by robust buying from Domestic Institutional Investors (DIIs), a continuing pattern that lends stability to the market. Key sector rotation patterns are suggesting a renewed interest in capital goods, private banks, and select consumer discretionary names, positioning the market for an initial upward thrust before consolidation.

Stock Focus 1 – Titan Company Ltd.

Titan is squarely in the spotlight today following its crucial quarterly business update, which provides the first look into consumer demand ahead of the festive season. The company’s jewellery division, the primary revenue driver, is expected to report stable to strong sales growth, driven by a combination of new store additions and robust demand for gold and studded jewellery. Investors will closely scrutinize the management commentary on same-store sales growth and margin expectations, especially given the volatility in gold prices. The stock’s pre-market movement will be dictated by the perceived success of its customer-facing strategies and inventory management. Analysts widely expect stable consumer demand amid the festive season, with Titan being the prime beneficiary of formalizing the jewellery market.

Stock Focus 2 – Tata Motors Ltd.

Tata Motors, a benchmark for the Indian auto sector, is in focus primarily due to its key monthly sales and exports data, as well as updates regarding its subsidiary, Jaguar Land Rover (JLR). A positive announcement regarding JLR’s order book, coupled with strong domestic sales driven by its Passenger Vehicle (PV) and Electric Vehicle (EV) segments, could provide a significant catalyst. The stock has seen consolidation after a strong rally, and key technical levels to watch are the immediate support at Rs. 920 and a crucial resistance zone around Rs. 980. Short-term traders should track the stock’s reaction to the sales numbers and look for a decisive break above or below these zones for momentum play.

Stock Focus 3 – Lodha Developers (Macrotech Developers Ltd.)

The real estate sector continues its multi-year upcycle, and Macrotech Developers is a key beneficiary. The stock is in focus due to anticipated updates on its quarterly bookings, project launches, and overall debt reduction strategy. Strong housing sales across Mumbai Metropolitan Region (MMR) and policy support from the government for the affordable and luxury segments are the tailwinds. The broader sentiment in the property market is highly positive, driven by stable interest rates and robust end-user demand. Institutional investor commentary suggests continued outperformance from established, financially sound developers, making Lodha a favoured play in the housing market. Investors should monitor project-specific cash flow guidance.

Sector Analysis and Broader Market View

The Auto sector is seeing cyclical recovery, with the EV push providing a long-term structural tailwind. While commodity prices pose a margin risk, strong festive demand is expected to override these concerns. The Consumer goods sector, specifically gold and luxury, is primed for the festive season, as highlighted by Titan’s focus, suggesting volume and value growth. Real estate maintains sustained housing momentum, supported by low inventory and policy initiatives, making the sector a key defensive/growth play.

From a technical standpoint, the Nifty 50 needs to decisively breach the 26,000 resistance level to trigger a fresh rally, while the immediate support sits near 25,800. The Sensex has critical support at 85,400. Derivative data shows continued healthy Call writing at higher strikes, suggesting resistance, but the Put/Call Ratio (PCR) is still indicating an underlying bullish sentiment. The India VIX (volatility index) remains subdued, implying market confidence, but traders should watch for intraday spikes in volatility.

Investor Strategy for the Day

For short-term traders, the focus should be on momentum stocks that break their key technical resistance levels on strong volume. Stocks like Titan and Tata Motors, if they deliver strong updates, could offer quick intraday opportunities. For long-term investors, this remains a ‘buy-on-dips’ market. High-quality names in the financial and capital goods sectors should be preferred for accumulation. Investors must strictly avoid chasing high valuations in speculative stocks and should book partial profits in names that have had a spectacular run recently. Stick to a data-driven strategy and do not succumb to market speculation.

Quick Investor Checklist

- FII/DII Flows: Confirm if DII buying continues to neutralise FII selling.

- Sector Rotation: Monitor the shift from defensive to cyclical stocks.

- Macro Cues: Watch for major US or European economic data releases

What This Means for Indian Retail Investors (The Retail Watch)

For small investors holding or planning to buy into these key companies, today is a day to observe. If you are a long-term holder of Titan or Tata Motors, the quarterly updates are affirmation of the growth story; avoid panic selling on minor dips. If you are planning to enter, use any initial profit-booking or market volatility to initiate a staggered purchase, rather than chasing the stock at the opening high. The key takeaway is simple: corporate updates provide facts, which should be the only basis for investment decisions, not pre-market hype or rumours. Focus on stable balance sheets and clear growth visibility, especially in consumer-facing businesses like these three.