On Thursday, September 18, 2025, the Indian stock market closed with marginal gains as optimism around the ongoing US-India trade talks bolstered investor sentiment. The Nifty 50 and Sensex extended their winning streak amid hopes of a positive turnaround in bilateral relations and prospects of a US Federal Reserve rate cut.

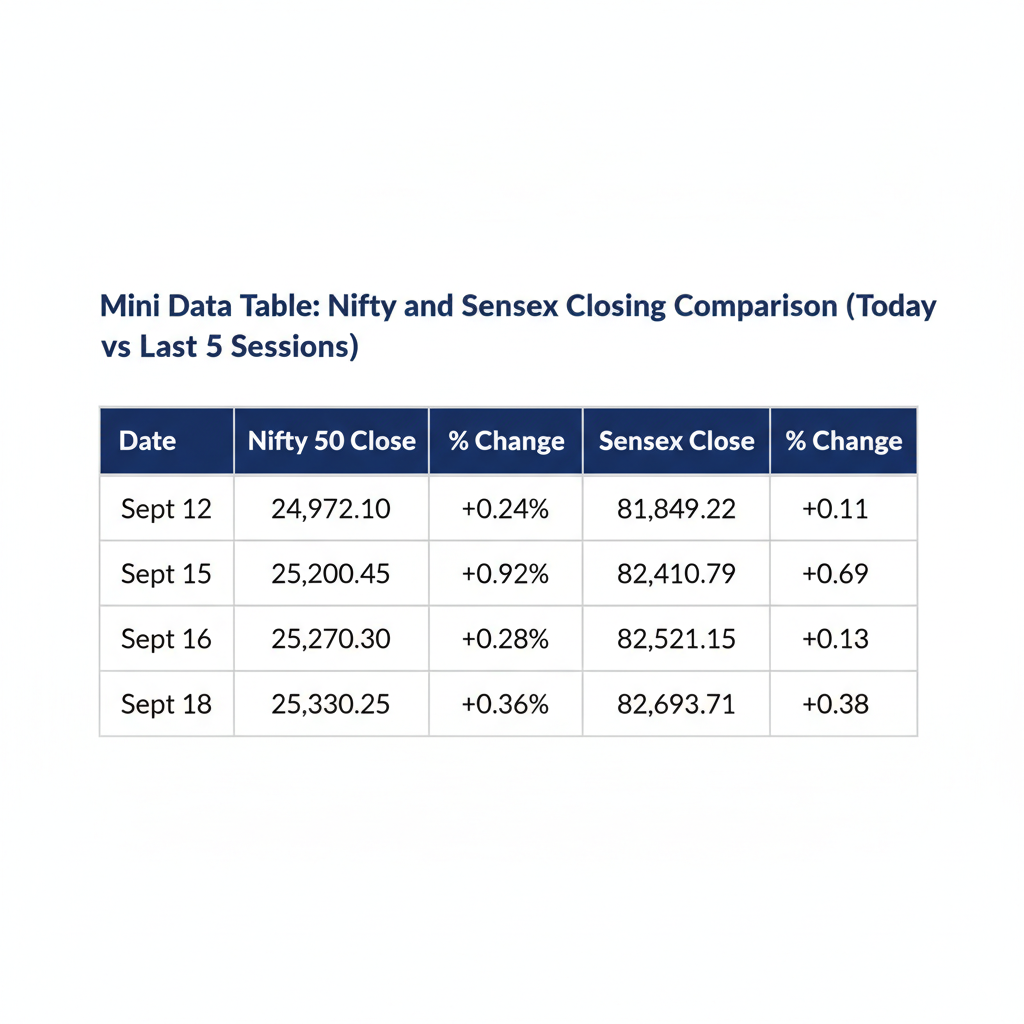

The NSE Nifty 50 ended the session at 25,330.25 points, up 91.15 points or 0.36%, while the BSE Sensex gained 313.02 points, or 0.38%, to close at 82,693.71. The indices traded in a relatively tight range, with intraday highs near 25,350 on the Nifty and over 82,700 for the Sensex, and lows just marginally lower than opening levels, signaling steady buying interest through the day.

Investor optimism was mainly driven by encouraging developments in the US-India trade talks. Official statements from the Indian Ministry of Commerce and Finance highlighted constructive discussions aimed at resolving trade issues and expanding market access, rejuvenating hopes for a bilateral trade pact. The presence of high-level US trade officials and progress toward ironing out tariff and non-tariff barriers were seen as positive signals. Additionally, expectations of a Federal Reserve interest rate cut later in the day further reinforced risk appetite among investors, supporting emergent market equities including India.

Sectorally, gains were seen predominantly in IT, banking, pharmaceuticals, and oil & gas. IT stocks advanced by about 0.7–1%, thanks to their strong US revenue exposure and anticipation of a weaker dollar post Fed rate cut. Banking shares, particularly PSU banks, rallied on prospects of lower interest rates boosting credit growth. Pharma stocks also edged higher, benefiting from expectations of improved export prospects tied to trade negotiation outcomes. Conversely, FMCG, metals, and consumer durables sectors lagged, weighed down by rising input costs and profit booking.

Among the top stock movers, major gainers included State Bank of India, Kotak Mahindra Bank, Tata Consumer Products, Maruti Suzuki, and Bharat Electronics. On the downside, Bajaj Finserv, Tata Steel, HDFC Life, and Titan Company faced selling pressure amid sectoral rotation and profit-taking. The broader markets also showed resilience, with Nifty Midcap and Smallcap indices ending marginally higher at 0.08% and 0.12%, respectively.

In terms of institutional flows, Foreign Portfolio Investors (FPIs) turned cautiously net sellers, offloading shares worth approximately Rs 990 crore despite the positive market trajectory. Meanwhile, Domestic Institutional Investors (DIIs) maintained steady buying momentum, acquiring equities worth around Rs 2,205 crore, marking consistent domestic support to the market rally. This interplay of cautious foreign selling and domestic buying indicated a balanced yet optimistic sentiment.

Globally, Indian markets were buoyed by supportive trends across other Asian equities and mixed cues from European markets. US equity futures traded higher ahead of the Federal Reserve’s monetary policy announcement, widely tipped to deliver a 25 basis point rate cut — the first since December last year — fostering a positive risk-on mood worldwide. Stable crude oil prices near $85 per barrel and a slightly softer US dollar also contributed favorably to emerging market currencies and equities, including the Indian rupee.

Technically, key support for the Nifty stands at 25,050, which has held firm over recent sessions, while immediate resistance lies near 25,800. For the Sensex, support is seen around the 82,200 mark, with resistance around 83,000 points. Market breadth was healthy, with more advancing stocks than decliners, indicating broad-based participation. Analysts suggest that a sustained break above resistance would reinforce bullish momentum, whereas a fall below support may signal consolidation.

A placeholder for expert views would include market strategists noting that while trade talks have infused optimism, investors should watch for global macro risks and upcoming policy announcements. Economists might comment on the potential economic benefits of a trade deal and monetary easing for India’s growth prospects.

For investors, the near-term outlook remains cautiously positive. The US-India trade discussions will be pivotal, with breakthroughs likely to spur stronger market rallies. Meanwhile, monitoring Foreign Portfolio Investor flows and technical market levels will be key to navigating potential volatility ahead.

Quick Investor Checklist Tomorrow, investors should track progress in US-India trade negotiations, observe FPI and DII activity for shifts in market sentiment, and watch for key technical levels at Nifty’s 25,050 support and 25,800 resistance.

Retail Watch

For everyday investors, the upbeat sentiment around US-India trade talks signifies potential improvements in business opportunities and job creation. A successful trade agreement could facilitate smoother export processes and attract more foreign investment, which tends to lift overall market confidence and can translate into steady returns on equity investments.