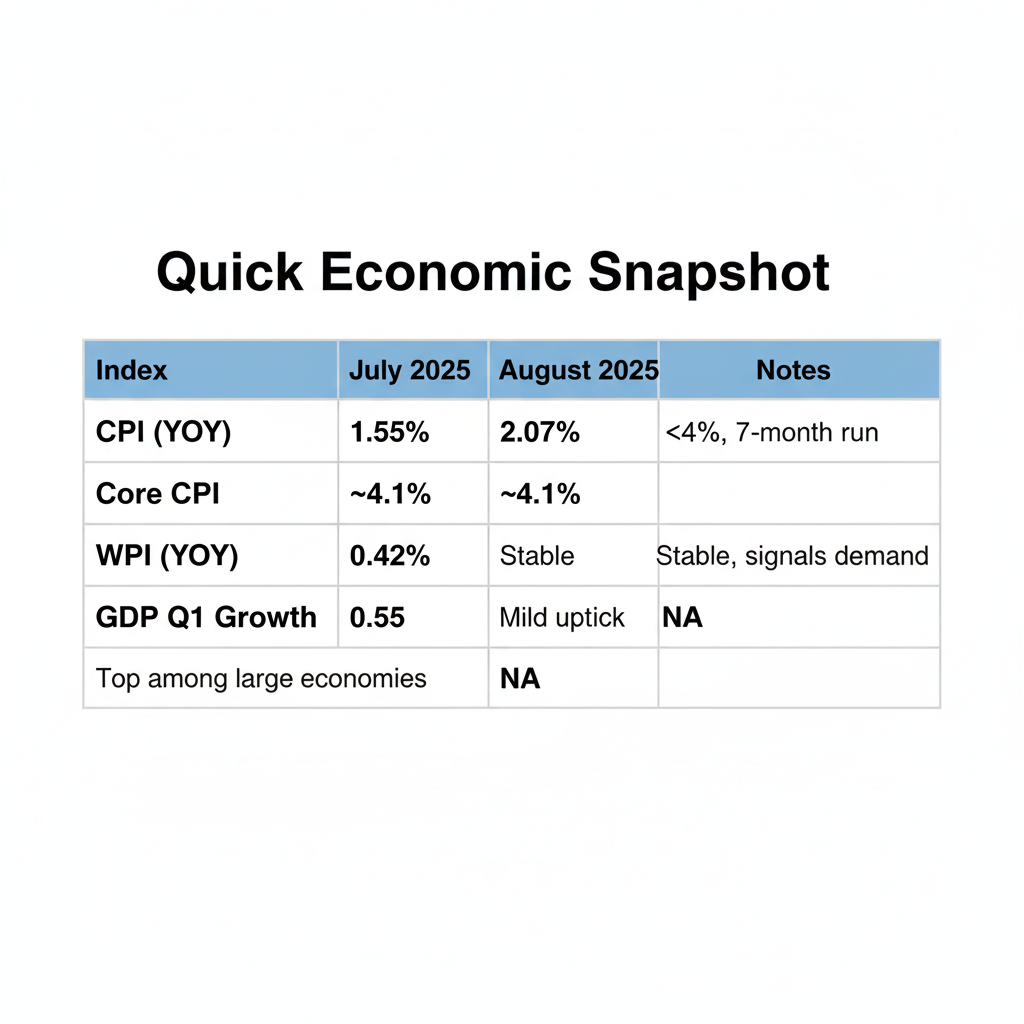

India’s retail inflation rose to 2.07% in August, marking the seventh consecutive month below the Reserve Bank of India’s (RBI) 4% target; meanwhile, Q1 GDP growth remained strong, underscoring the economy’s resilience in a globally volatile environment.

India’s Consumer Price Index (CPI) for August came in at 2.07%, up from July’s twelve-year low of 1.55%. For retail investors and policymakers, this data point represents a modest uptick, but maintains the comfort of sub-4% price stability rarely seen in developing economies. Year-on-year, inflation has been on a declining trajectory: August’s figure was the first monthly increase in nearly a year, largely reflective of dissipating base effects and minor increases in certain food categories.

Delving into the drivers, the moderation in food prices has been a defining feature of recent inflation prints. The annual food inflation rate remained in negative territory for the third straight month, coming in at -0.69% in August. Deflation in food is paired with a 15.92% drop in vegetable prices, a notable though less pronounced decline than July’s 20.69% drop. However, select categories such as meat, fish, oils, and eggs contributed to the headline uptick. Core inflation—excluding food and energy—stood at around 4.1%, suggesting underlying demand remains healthy, supported by steady rises in personal care, housing, and miscellaneous expenses.

The RBI’s inflation targeting framework has been instrumental in shaping policy responses and investor expectations. The central bank’s explicit target is 4%, with a permissible tolerance band of 2% to 6%. August marks the seventh month with inflation below the 4% midpoint, enabling the RBI to sustain a neutral monetary policy stance after delivering 100 basis points in rate cuts since February. Analysts expect the RBI to pause at its next meeting but acknowledge scope for further easing if growth risks materialize towards year-end. Policy continuity is further ensured by the RBI’s intent to retain the headline inflation anchor at 4% for the foreseeable future, reflecting consensus among major stakeholders and international best practices.

For Indian households, subdued inflation brings much-needed relief after years of price volatility. Essentials such as rice, vegetables, pulses, and edible oils have seen either price declines or moderation, boosting real purchasing power for both urban and rural consumers. With fuel and transportation inflation also decelerating, family budgets have been shielded from the shocks typical of food and energy cycles. Stable prices underpin confidence in the economy, with greater ability to plan expenditures, save, and invest for the future.

Sectoral impacts are visible across consumer-facing industries. The Fast-Moving Consumer Goods (FMCG) sector has benefitted from benign input costs, allowing for lower product prices and expanded margins, particularly in categories dependent on agricultural commodities and packaging. The auto sector, highly sensitive to interest rates and consumer sentiment, has seen robust demand with lending rates trending lower and no major cost spikes in metals or logistics. Banks and non-banking financial companies, meanwhile, have navigated strong credit growth but face narrower interest margins as rates stabilize or fall. Rural demand remains resilient, driven by stable inflation, government support, and decent monsoon performance, despite concerns over localized crop losses from unusual rainfall.

GDP growth in Q1 has been impressive, with provisional estimates placing annual expansion above 6.5%—the highest among major economies. The principal drivers have been robust private consumption, infrastructure-led government investment, and net export gains despite global headwinds. Consumption, representing over half of GDP, accelerated as households gained confidence from stable prices and rising incomes. Investment surged, underpinned by large government capex initiatives and strong residential/commercial real estate activity. Export performance exceeded expectations in both services (IT, financial) and select manufactured goods, helped by competitive exchange rates and resilient global demand.

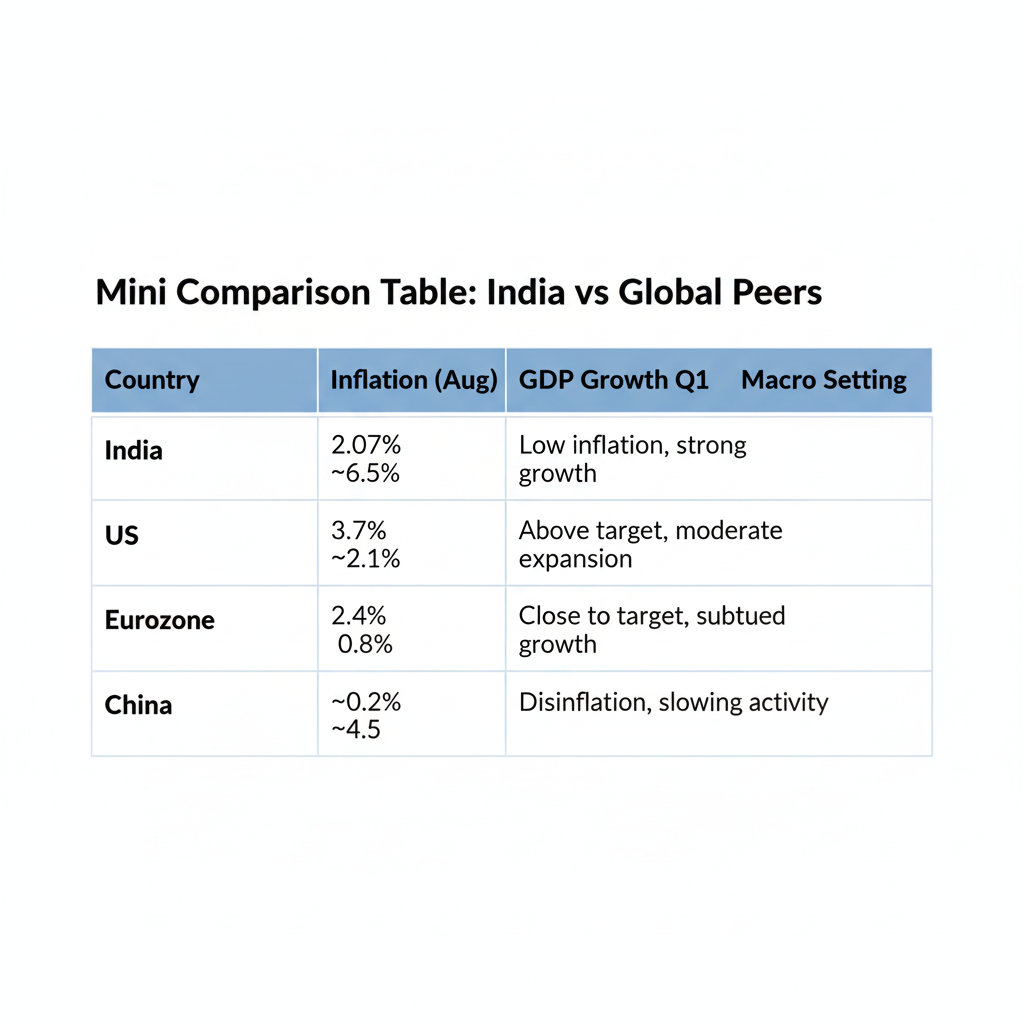

Comparing India to global peers underscores its unique macroeconomic position. In August, headline US inflation ran near 3.7%, driven by services, shelter, and energy, despite the Federal Reserve’s tight policy stance. The Euro Area registered about 2.4% inflation, still grappling with supply chain recovery and energy volatility. China, meanwhile, flirted with disinflation—prices rising just above zero—amid severe real estate and export weakness. India’s rare blend of sub-2.5% inflation and 6%+ GDP growth sets it apart as an outlier among both major and emerging markets, reflected in bullish sentiment from organisations like the IMF and World Bank.

Financial markets responded to the August inflation data with measured optimism. The NSE Nifty and BSE Sensex registered minor gains, banking on the prospect of sustained monetary accommodation and resilient earnings outlook. Bond markets saw yields drift lower on rate cut hopes and continued foreign purchases. The rupee held steady, trading in a narrow band, reflecting FII inflows into equity and debt alike. Moderated inflation and positive growth helped anchor risk premiums and improved investor confidence in both domestic and external markets.

Expert commentary reflects cautious optimism. [Placeholder: “With inflation well below the RBI’s target, India is set for a policy pause, but growth risks from erratic monsoons and external headwinds warrant close monitoring,” said a senior RBI economist.] [Placeholder: “Low inflation boosts household consumption but could pressure corporate margins, especially in export-intensive sectors facing global tariffs,” noted a leading market strategist.] [Placeholder: “India’s unique position in the global growth league stems from prudent policy mix and sustained domestic demand,” commented a World Bank Asia economist.]

Retail investors and business owners can draw several actionable lessons. For households, the current inflation regime supports improved purchasing power and stable household budgeting. For equity investors, consumer staples, autos, and housing stocks are attractive given muted cost pressures and robust demand. Fixed-income investors can expect gradual declines in bond yields, particularly if the RBI opts for further easing. Exporters and SMEs benefit from rupee stability and competitive positioning, but should watch for possible swings in global demand.

The outlook for inflation and growth remains balanced and upbeat. RBI’s ongoing commitment to the 4% inflation target framework ensures policy credibility and anchors inflation expectations. Risks stem mainly from food price shocks linked to crop/weather disruptions and external variables like oil prices. Nevertheless, strong Q1 GDP momentum, manageable inflation, and favorable global interest rate cycles provide India with an enviable growth-stability mix. For policymakers, remaining nimble in adjusting fiscal and monetary policies will be crucial to sustaining this trajectory through the remainder of 2025 and beyond.

Retail Watch: How Sub-4% Inflation Helps Households

When inflation remains below 4%, the prices of everyday essentials—food, fuel, and housing—rise at a slow, predictable pace, making it simpler for families to manage budgets and plan for the future. With prices stable or falling for key food items and fuel, Indian families experience less financial stress, can save more, and have greater confidence in making large purchases or investing.