India Rises as Fourth-Largest Economy: A New Global Blueprint

India Overtakes Japan, Cementing Its Place as a Global Growth Engine

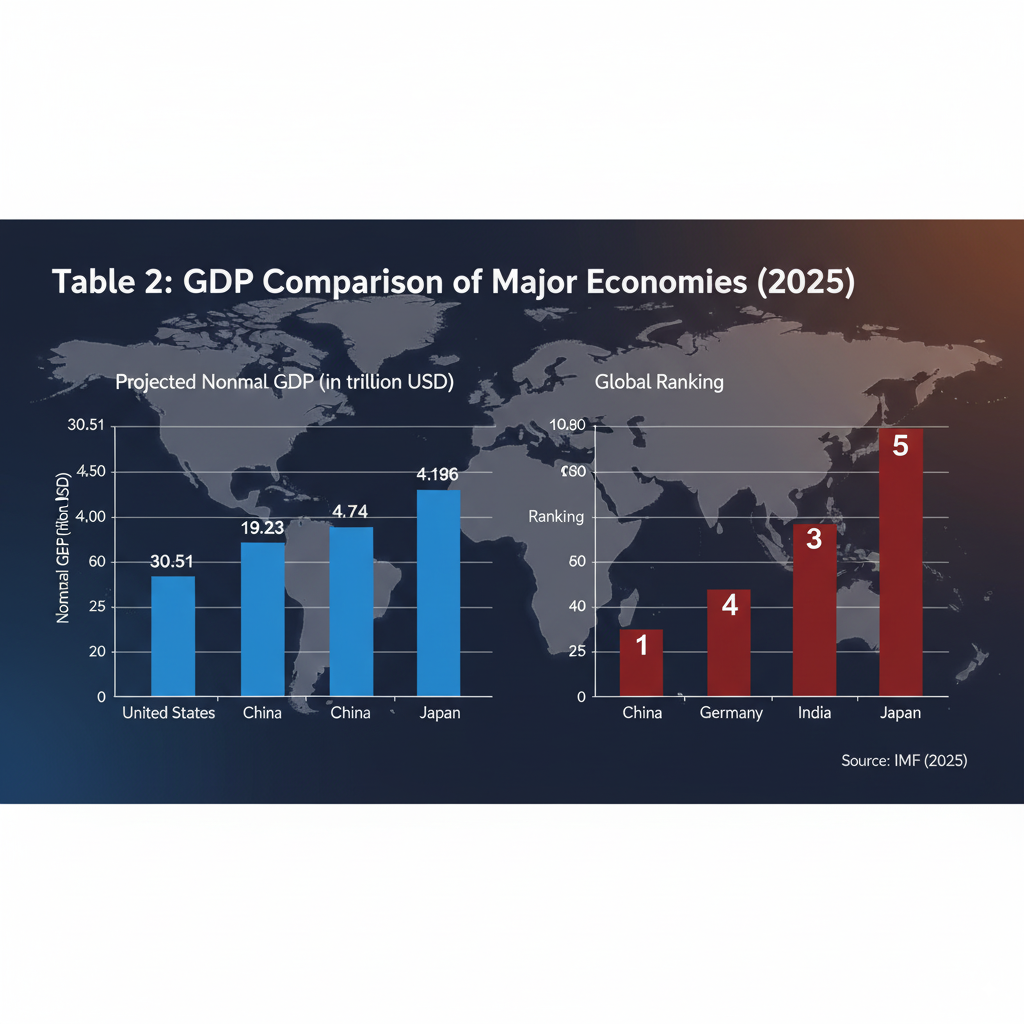

In a significant economic milestone, India has surpassed Japan to become the world’s fourth-largest economy. With its nominal GDP projected to reach $4.19 trillion in 2025, India’s ascent marks a new chapter in its economic journey, driven by robust domestic demand, strategic policy reforms, and a burgeoning industrial base. This achievement, coming at a time of heightened global uncertainty and subdued growth, underscores India’s resilience and its growing influence on the world stage.

This shift, as projected by the International Monetary Fund (IMF), is not merely a symbolic victory but a reflection of the fundamental changes underway in the Indian economy. While Japan faces demographic and structural challenges, India’s economic momentum has been sustained by a young, vibrant population and a push towards manufacturing and infrastructure development. The IMF’s latest World Economic Outlook (WEO) report for 2025 positions India as the fastest-growing major economy, outpacing global growth projections. This is a powerful signal to international investors and a testament to the country’s long-term potential.

Core Economic Indicators: A Data-Driven Picture

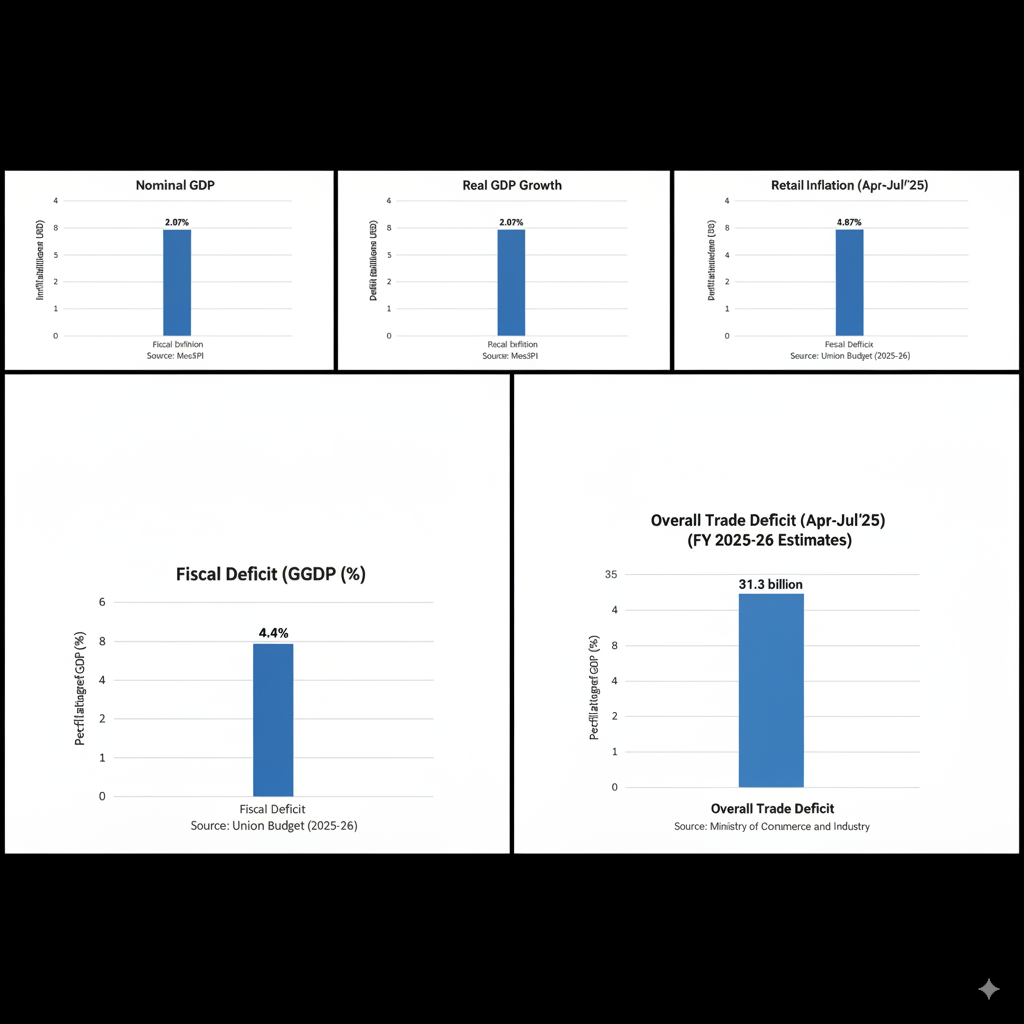

The narrative of India’s economic rise is supported by key data points from official sources. The Ministry of Statistics and Programme Implementation (MoSPI) reported a strong start to the fiscal year 2025-26, with real GDP growth estimated at a robust 7.8% in the first quarter (April-June). This performance was underpinned by significant growth in the tertiary sector, which recorded a 9.3% increase, and a healthy expansion in the manufacturing and construction sectors, both growing at over 7.5%. GDP Growth: The IMF forecasts a growth rate of 6.2% for 2025 and 6.3% for 2026, while the World Bank pegs the FY26 projection at 6.3%. Another government source indicates a growth range of 6.3% to 6.8% for FY26, cementing India’s position as the world’s fastest-growing major economy.

Inflation: India’s retail inflation has been successfully managed, with the Consumer Price Index (CPI) inching up to 2.07% in August, well within the Reserve Bank of India’s (RBI) mandated target of 4%.

Fiscal Deficit: The Union Budget for 2025-26 projects the fiscal deficit to be 4.4% of the GDP, reflecting the government’s continued focus on fiscal consolidation.

industrial Production (IIP): The Index of Industrial Production (IIP) for June 2025 showed a growth of 1.5%, with strong contributions from sectors like basic metals, fabricated metal products, and manufacturing of coke and refined petroleum products.

Trade Balance: India’s overall trade deficit for April-July 2025-26 narrowed by 3.7% to $31.3 billion, largely on the back of strong services exports, which grew by 7.9% in the same period. However, the merchandise trade deficit widened to $94.8 billion.

The Policy Angle: A Strategic Approach

The country’s economic stability is a direct result of a calibrated policy approach by the government and the RBI. The Finance Ministry’s focus on capital expenditure, with an allocation of ₹11.21 lakh crore for FY26, is designed to boost long-term growth and crowd-in private investment. On the monetary front, the RBI continues its commitment to price stability under the flexible inflation targeting framework, which aims to keep CPI inflation at 4%.

Globally, institutions like the IMF have consistently revised India’s growth projections, even as global trade tensions and uncertainty have led to downward revisions for many other economies. According to the IMF, India’s stable expansion is being “supported by firm private consumption, particularly in rural areas”. The World Bank, too, has highlighted that India’s growth is expected to remain stable, driven by “reform momentum supporting robust consumption growth and a push for public investment”.

Impact on Businesses & Key Sectors

India’s economic growth is having a tangible impact on its corporate landscape and key sectors. The government’s strategic initiatives, such as the Production-Linked Incentive (PLI) schemes and the development of industrial corridors, are transforming India into a manufacturing and industrial powerhouse. The emergence of cities like Kochi and Vizag as new industrial centers, coupled with the expansion of integrated infrastructure, is creating a cohesive ecosystem for businesses.

This has attracted global majors in sectors like electronics, electric vehicles (EVs), and semiconductors, who are now setting up plants in India, leveraging the country’s skilled workforce and policy reforms. The manufacturing sector, in particular, is a key driver, with the government extending a 15% tax rate for new manufacturing units until 2024 to further boost investment. While private sector capital expenditure has yet to pick up meaningfully, domestic consumption remains the key pillar of growth for now.

Global Comparison: India vs. Peers

India’s economic performance stands out in comparison to its global peers. The IMF’s projection of India’s 6.2% growth in 2025 is significantly higher than the global growth forecast of 2.8%. While the US and China are expected to remain the world’s top two economies, with projected GDPs of $30.51 trillion and $19.23 trillion, respectively, India is rapidly closing the gap with Germany, which is forecast to have a nominal GDP of $4.74 trillion in 2025.

The economic landscape is also shaped by geopolitical factors. The ongoing trade tensions, particularly with the US, have led to downward revisions in global growth forecasts. However, experts believe that if talks between India and the US progress well, the impact of these tariff disputes on growth could be manageable. India’s diplomatic pushback against protectionist policies, while diversifying its trade partners, positions it uniquely in the new world order.

Expert Opinions & The Road Ahead

According to Indranil Pan, Chief Economist at Yes Bank, while India’s growth is strong, the outlook depends on several “moving pieces,” including global trade tensions and urban consumption trends. He noted that while government policy and a strong rural demand are supportive, the lack of a meaningful pickup in private capex and slow transmission of RBI rate cuts remain areas to watch. Fitch Ratings, on the other hand, has a more bullish outlook, revising India’s FY26 GDP growth forecast to 6.9%, citing resilient domestic demand and GST reforms.

Looking forward, the momentum is on India’s side. The IMF projects India to become the world’s third-largest economy in 2.5-3 years, with a goal of becoming a $7.3 trillion economy by 2030. The World Bank expects growth to recover to 6.6% in FY27 and FY28, with a pickup in exports driven by robust services activity. The key challenges will be fostering job creation, ensuring labor market flexibility, and continuing to invest in education and infrastructure to sustain this trajectory.

What This Means for Indian Retail Investors

For the average Indian retail investor, this new economic reality presents both opportunities and responsibilities. The re-rating of India’s economy is likely to attract more Foreign Portfolio Investments (FPIs), which can lead to increased liquidity and a more buoyant stock market. Sectors linked to domestic consumption, infrastructure, and manufacturing—such as consumer durables, construction, and capital goods—are likely to see strong growth. However, investors should remain cautious and not get swayed by market euphoria. The economy’s growth is not without challenges, and factors like global trade tensions and inflation remain key risks. It is essential to focus on fundamentally strong companies and maintain a long-term investment horizon.