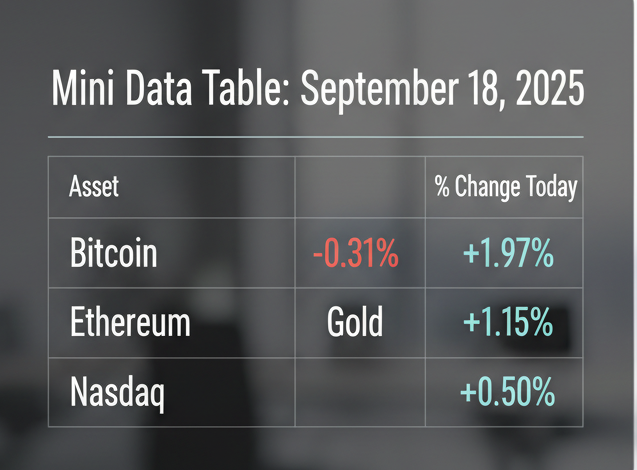

Bitcoin and Ethereum prices gained following dovish signals from the US Federal Reserve, bolstering investor sentiment in risk assets including cryptocurrencies. Bitcoin hovered around $116,174 with a slight dip of 0.31% in the last 24 hours, while Ethereum showed more strength, up about 1.97% to nearly $4,594, supported by strong inflows and robust on-chain activity as of September 18, 2025.

The central bank’s signals pointed to a softer stance on interest rates, fueling expectations for a prolonged period of lower borrowing costs. This scenario weakens the US dollar index, making riskier assets such as crypto more attractive. The reduced cost of capital encourages investors to allocate funds to volatile assets like Bitcoin and Ethereum with a higher growth potential compared to traditional safe havens like gold. This shift was reflected in broader market movements, with altcoins like Binance Coin, Solana, XRP, and Dogecoin also registering gains in the 0.8% to 3.6% range.

In India, crypto exchanges such as WazirX and CoinDCX recorded steady trading volumes despite an ongoing regulatory uncertainty backdrop and the imposition of taxes on crypto gains by the government. INR-to-crypto exchange rates remained stable, displaying investor resilience and continued appetite for digital assets despite the regulatory challenges and fluctuating rupee value. The Indian crypto community remains engaged, buoyed by the global risk-on sentiment in equities and digital assets.

Globally, crypto markets across the US, Europe, and Asia demonstrated varied responses to the Fed move. While the US market favored risk assets, European investors weighed recent regulatory discussions, and Asian markets saw growing adoption fueled by technological innovation and institutional participation. This diverse regional activity shows crypto’s evolving role as both an investment and a technological asset class with distinct local and global drivers.

Despite the rally, risks remain significant. Crypto markets continue to witness elevated volatility, with sharp price swings tied to news flow and regulatory developments. The potential for the Fed to reverse its policy stance or increase rates remains an overhang. Regulatory uncertainty, including evolving rules in key markets like the US, EU, and India, pose risks to sustained momentum. Investors must remain cautious as these factors could trigger corrections or stall gains at any stage.

Crypto analysts emphasize that while the dovish Fed environment is positive, it does not guarantee sustained upside as market dynamics can shift rapidly. “The Fed’s signaling has reignited risk appetite, but cryptocurrencies are inherently volatile and remain vulnerable to macro policy shifts and regulatory pressures,” said a senior crypto strategist (placeholder). An economist at a leading global financial firm adds, “The interplay between monetary policy and crypto asset flows is nuanced. Lower rates boost liquidity but also increase speculative risk, requiring investors to maintain balanced portfolios” (placeholder).

For investors, tracking key signals such as Fed communications, volatility indices in crypto, trading volumes on major exchanges, and evolving regulations will be crucial for navigating near-term market movements. With Bitcoin and Ethereum showing strength relative to traditional assets like gold and major equity indices like Nasdaq, crypto continues to position itself as a strategic risk asset amid uncertain macroeconomic conditions.

Bitcoin and Ethereum prices gained following dovish signals from the US Federal Reserve, bolstering investor sentiment in risk assets including cryptocurrencies. Bitcoin hovered around $116,174 with a slight dip of 0.31% in the last 24 hours, while Ethereum showed more strength, up about 1.97% to nearly $4,594, supported by strong inflows and robust on-chain activity as of September 18, 2025.

The central bank’s signals pointed to a softer stance on interest rates, fueling expectations for a prolonged period of lower borrowing costs. This scenario weakens the US dollar index, making riskier assets such as crypto more attractive. The reduced cost of capital encourages investors to allocate funds to volatile assets like Bitcoin and Ethereum with a higher growth potential compared to traditional safe havens like gold. This shift was reflected in broader market movements, with altcoins like Binance Coin, Solana, XRP, and Dogecoin also registering gains in the 0.8% to 3.6% range.

In India, crypto exchanges such as WazirX and CoinDCX recorded steady trading volumes despite an ongoing regulatory uncertainty backdrop and the imposition of taxes on crypto gains by the government. INR-to-crypto exchange rates remained stable, displaying investor resilience and continued appetite for digital assets despite the regulatory challenges and fluctuating rupee value. The Indian crypto community remains engaged, buoyed by the global risk-on sentiment in equities and digital assets.

Globally, crypto markets across the US, Europe, and Asia demonstrated varied responses to the Fed move. While the US market favored risk assets, European investors weighed recent regulatory discussions, and Asian markets saw growing adoption fueled by technological innovation and institutional participation. This diverse regional activity shows crypto’s evolving role as both an investment and a technological asset class with distinct local and global drivers.

Despite the rally, risks remain significant. Crypto markets continue to witness elevated volatility, with sharp price swings tied to news flow and regulatory developments. The potential for the Fed to reverse its policy stance or increase rates remains an overhang. Regulatory uncertainty, including evolving rules in key markets like the US, EU, and India, pose risks to sustained momentum. Investors must remain cautious as these factors could trigger corrections or stall gains at any stage.

Crypto analysts emphasize that while the dovish Fed environment is positive, it does not guarantee sustained upside as market dynamics can shift rapidly. “The Fed’s signaling has reignited risk appetite, but cryptocurrencies are inherently volatile and remain vulnerable to macro policy shifts and regulatory pressures,” said a senior crypto strategist (placeholder). An economist at a leading global financial firm adds, “The interplay between monetary policy and crypto asset flows is nuanced. Lower rates boost liquidity but also increase speculative risk, requiring investors to maintain balanced portfolios” (placeholder).

For investors, tracking key signals such as Fed communications, volatility indices in crypto, trading volumes on major exchanges, and evolving regulations will be crucial for navigating near-term market movements. With Bitcoin and Ethereum showing strength relative to traditional assets like gold and major equity indices like Nasdaq, crypto continues to position itself as a strategic risk asset amid uncertain macroeconomic conditions.

Quick Investor Checklist: Investors should monitor US Federal Reserve statements and rate outlook; watch for spikes in crypto market volatility; track volumes on exchanges like WazirX and CoinDCX indicating market participation; and stay updated on regulatory changes across jurisdictions.Bitcoin and Ethereum prices gained following dovish signals from the US Federal Reserve, bolstering investor sentiment in risk assets including cryptocurrencies. Bitcoin hovered around $116,174 with a slight dip of 0.31% in the last 24 hours, while Ethereum showed more strength, up about 1.97% to nearly $4,594, supported by strong inflows and robust on-chain activity as of September 18, 2025.

The central bank’s signals pointed to a softer stance on interest rates, fueling expectations for a prolonged period of lower borrowing costs. This scenario weakens the US dollar index, making riskier assets such as crypto more attractive. The reduced cost of capital encourages investors to allocate funds to volatile assets like Bitcoin and Ethereum with a higher growth potential compared to traditional safe havens like gold. This shift was reflected in broader market movements, with altcoins like Binance Coin, Solana, XRP, and Dogecoin also registering gains in the 0.8% to 3.6% range.

In India, crypto exchanges such as WazirX and CoinDCX recorded steady trading volumes despite an ongoing regulatory uncertainty backdrop and the imposition of taxes on crypto gains by the government. INR-to-crypto exchange rates remained stable, displaying investor resilience and continued appetite for digital assets despite the regulatory challenges and fluctuating rupee value. The Indian crypto community remains engaged, buoyed by the global risk-on sentiment in equities and digital assets.

Globally, crypto markets across the US, Europe, and Asia demonstrated varied responses to the Fed move. While the US market favored risk assets, European investors weighed recent regulatory discussions, and Asian markets saw growing adoption fueled by technological innovation and institutional participation. This diverse regional activity shows crypto’s evolving role as both an investment and a technological asset class with distinct local and global drivers.

Despite the rally, risks remain significant. Crypto markets continue to witness elevated volatility, with sharp price swings tied to news flow and regulatory developments. The potential for the Fed to reverse its policy stance or increase rates remains an overhang. Regulatory uncertainty, including evolving rules in key markets like the US, EU, and India, pose risks to sustained momentum. Investors must remain cautious as these factors could trigger corrections or stall gains at any stage.

Crypto analysts emphasize that while the dovish Fed environment is positive, it does not guarantee sustained upside as market dynamics can shift rapidly. “The Fed’s signaling has reignited risk appetite, but cryptocurrencies are inherently volatile and remain vulnerable to macro policy shifts and regulatory pressures,” said a senior crypto strategist (placeholder). An economist at a leading global financial firm adds, “The interplay between monetary policy and crypto asset flows is nuanced. Lower rates boost liquidity but also increase speculative risk, requiring investors to maintain balanced portfolios” (placeholder).

For investors, tracking key signals such as Fed communications, volatility indices in crypto, trading volumes on major exchanges, and evolving regulations will be crucial for navigating near-term market movements. With Bitcoin and Ethereum showing strength relative to traditional assets like gold and major equity indices like Nasdaq, crypto continues to position itself as a strategic risk asset amid uncertain macroeconomic conditions.

Quick Investor Checklist

Investors should monitor US Federal Reserve statements and rate outlook; watch for spikes in crypto market volatility; track volumes on exchanges like WazirX and CoinDCX indicating market participation; and stay updated on regulatory changes across jurisdictions.nvestors should monitor US Federal Reserve statements and rate outlook; watch for spikes in crypto market volatility; track volumes on exchanges like WazirX and CoinDCX indicating market participation; and stay updated on regulatory changes across jurisdictions.

The Fed’s dovish stance generally means lower borrowing costs, which encourages investment in growth-focused, riskier assets like cryptocurrencies. For retail investors, this environment supports crypto buying opportunities but calls for caution due to heightened volatility. Maintaining a clear risk management plan and avoiding impulsive trading during price swings will enhance investment outcomes.

Bitcoin and Ethereum’s gains following dovish Fed signals underline the importance of macroeconomic policy as a driver of crypto market sentiment. While the short-term momentum looks promising, regulatory and volatility risks necessitate vigilant market monitoring. For crypto investors, a balanced approach leveraging macro insights and technical caution remains the safest path forward.