L&T Technology Services (LTTS) has signalled both operational strength and strategic ambition with the announcement of a transformative $100 million, multi-year deal with a US-headquartered industrial equipment manufacturer operating at the heart of the global semiconductor value chain. The deal, which spans artificial intelligence, digital engineering, and semicon applications, is not just another client win but a concrete marker of LTTS’s global ambitions in the critical, high-growth fields of AI, automation, and chip-sector engineering—the very domains that will define the next decade of competitive technology leadership.PRIVACY AND POLICY

Deal Structure: Scope and Scale

Under the framework of the contract, LTTS will participate in new product development, sustenance engineering, value engineering, and platform automation for the US client, leveraging its advanced capabilities in AI, computer vision, and next-generation automation technologies. The agreement also involves creation of a dedicated Center of Excellence (CoE) to drive innovation, streamline platform engineering, and develop AI-powered application ecosystems—a move that embeds LTTS deeply into the client’s own digital and innovation infrastructure. While the precise start and duration of the contract remain undisclosed, multi-year agreements of this size are typically structured to run three to five years, providing LTTS with healthy revenue visibility and order-book

Why This Deal Matters: Strategic Significance

For LTTS, this is a landmark win that affirms its transition from a traditional engineering services player to an AI-driven, platform-centric digital engineering leader. The company has steadily broadened its playbook from legacy product engineering to advanced automation, AI, and digital transformation—a journey that now sees it partner with US majors at the intersection of semicon, smart manufacturing, and AI-driven industrial automation. Amit Chadha, CEO & Managing Director, LTTS, underlined the significance, stating, “This engagement underscores LTTS’s expertise in leveraging AI-driven innovation to address complex engineering challenges in high-growth industries. By harnessing our capabilities in AI, automation, and product engineering, we are empowering our client to further expand their market share and stay ahead of the curve.

The contract is classified under LTTS’s “Sustainability” segment—a strategic business unit that has emerged as a key growth driver, reflecting the global pivot toward net-zero, digital, and automated industrial ecosystems. The partnership also fits LTTS’s ongoing push for large, transformational programs, which promise to deliver both higher-margin work and multi-year annuity-like revenue streams.

Impact on LTTS: Order Book, Margins, Global Footprint

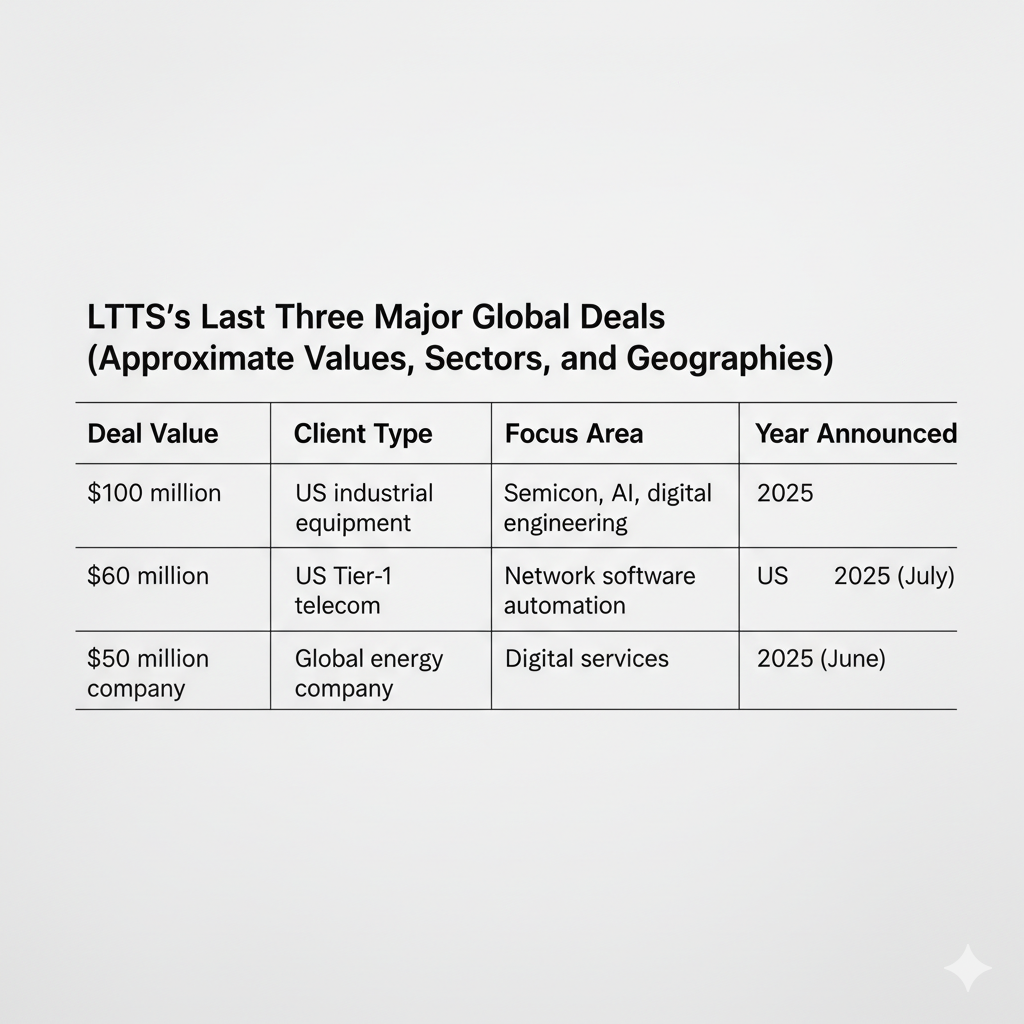

The $100 million deal will directly bolster LTTS’s order book—by far its strongest in at least the last two years. This win follows other major announcements, including a $60 million deal with a Tier-I US telecom provider for network software automation and a $50 million digital services agreement with a global energy company. Such deals reduce the company’s reliance on smaller, project-based work and signal investor-friendly revenue sustainability.

Immediately after the announcement, LTTS shares gained 1%, reflecting positive investor sentiment on the back of strong deal visibility and confidence in execution. The Street is watching for signs that these large deals can be delivered on time, within budget, and to high client satisfaction—a metric that will be closely scrutinized in the firm’s upcoming quarterly results. With the US remaining LTTS’s largest export market—accounting for nearly 60% of its global revenues—this deal reinforces the company’s position as a key engineering partner to US industrial majors.

What This Deal Signals for India’s Engineering Services Sector

The LTTS deal is a bellwether for the broader Indian engineering services export sector. India’s IT and engineering services firms have long been valued for their cost-effective talent and execution depth, but deals of this nature—high-value, strategic, and embedded in the client’s innovation engine—signal a maturing of the industry. Indian engineering services firms are increasingly seen not as “vendors,” but as essential partners in global semiconductor, AI, and digital engineering value chains. The ability to co-develop next-gen automation, AI-driven product platforms, and digital twins is now a central part of the value proposition being offered to US and European multinationals.

India’s engineering services exports remain structurally resilient, with the US accounting for nearly 70% of export earnings and the sector largely insulated from recent US tariff hikes aimed at goods, not services. However, the long-term risk is that heightened US protectionism or a broader economic downturn could pressure clients to curtail discretionary, large-scale engineering investments. For now, though, the US-India IT corridor remains robust, sustained by rising demand for AI, cybersecurity, and platform automation.

How Rivals Stack Up: TCS, Infosys, Wipro, and Global Peers

While LTTS is smaller than TCS, Infosys, and Wipro, it has carved a distinct niche in engineering research and development (ER&D), especially in industrial, automotive, and semiconductor segments. TCS and Infosys have dominant positions in enterprise IT and cloud, but LTTS’s focused engineering prowess gives it an edge in industrial digital transformation and smart manufacturing. Globally, LTTS now competes with the likes of Altran (part of Capgemini), Akka Technologies, and Quest Global for high-value engineering services contracts in Europe and North America.

What If Scenarios: Risks and Mitigation

- Demand Slowdown in Semicon/AI: A global recession or a steep correction in semiconductor/AI investment could delay or reduce the scale of LTTS’s transformational programs. However, the company’s exposure is partly hedged by annuity-style, multi-year contracts and its diversified sectoral presence (including healthcare, transportation, and industrial products).

- Rising US Protectionism: While India’s IT services sector remains largely insulated from recent US tariff hikes, a broader push for “onshoring” or “friendshoring” of critical engineering work could, over time, erode the India-US engineering services corridor. LTTS has been proactive in setting up local delivery centers and COEs in the US and Europe to mitigate this risk.thehindubusinessline

- Client Concentration: This deal, while transformational, also increases LTTS’s dependence on a handful of large clients. Any disruption in these relationships—due to performance, client-side restructuring, or M&A—could have an outsized impact on LTTS’s financials.

Expert Commentary (Placeholder for Analyst/Industry Leader Quotes)

“LTTS’s latest deal is a validation of India’s engineering services capabilities in the most sophisticated domains of AI and semicon. While execution risk is always a concern with large, multi-year engagements, LTTS has shown it can deliver at scale. The real test will come as the company integrates these wins into its medium-term $2 billion revenue target.

“The US remains Indian IT’s most important market. Deals like this remind us that while cost arbitrage was the starting point, innovation, domain depth, and platform capabilities are now the real differentiators.”

“For global engineering majors, the combination of Indian talent and platform-based automation is becoming a force multiplier. LTTS is now at the forefront of this shift, but competitors will not stand still.”

Retail Watch: Why This Matters for Small Investors

For retail investors, the $100 million deal is a clear positive—boosting LTTS’s revenue visibility, order book, and sectoral credibility. However, investors should monitor:

- Deal Execution: Large contracts bring both opportunity and risk. Delays, cost overruns, or client dissatisfaction can quickly turn a win into a liability.

- Semiconductor and AI Demand Cycles: LTTS’s growth is now intricately tied to the global appetite for semicon, AI, and digital engineering. A cyclical downturn in these sectors could dampen medium-term growth.

- US Client Dependence: While the US market is LTTS’s bread and butter, over-reliance on any single geography or client is a risk that needs to be managed.

- Margins and Cash Flows: Investors should watch for margin trends in quarterly results, as large deals can sometimes come with higher upfront costs or lower initial margins.

Quick Investor Checklist

Track These Four Factors Closely

- Deal Execution: Watch for quarterly updates on delivery milestones and client feedback.

- Semiconductor Demand: Monitor global semicon capex and AI investment trends.

- AI Adoption: Look for signs of LTTS deepening its AI and automation offerings across sectors.

- US Client Dependency: Assess the balance of LTTS’s revenue base and geographic diversification.

Long-Term Outlook: Opportunities and Risks

The global semiconductor industry is projected to cross $1 trillion in annual revenue by 2030, with AI and automation driving much of that growth. LTTS, with its deepening expertise in these areas, is well-positioned to capture a larger share of the outsourced engineering services market. The company’s focus on establishing COEs and local delivery centers in key markets also provides a hedge against rising protectionism and supports a “glocal” (global + local) delivery model.

However, the company’s transition from a project-based to a platform-driven, annuity-model business is still a work in progress. Execution on large deals, maintaining client trust, and staying ahead of technological disruption are all critical to sustaining growth. The risk of client concentration and the potential for a global macroeconomic slowdown remain material concerns.

Conclusion: Growth Potential with Execution Risks

L&T Technology’s $100 million US deal is a watershed moment for the company and a positive signal for India’s engineering services export sector. It underscores LTTS’s ability to win and deliver complex, high-value programs in the most strategic domains of global technology. For investors, the deal boosts confidence in LTTS’s growth trajectory, but also underlines the importance of careful monitoring—especially on execution, client diversification, and global tech demand cycles. LTTS is now playing in the premier league of global engineering services, but the game is only getting tougher.