SEBI Delivers Major Win for Adani Group as Hindenburg Charges Get Dismissed

India’s market regulator has given Adani Group a massive boost by quashing most Hindenburg Research allegations, marking a turning point for one of the country’s largest conglomerates. This SEBI Adani Group verdict brings much-needed regulatory relief and signals the end of months of market turbulence that started with the short-seller’s damaging report in early 2023.

Who This Matters To: Investors holding Adani stocks, fund managers tracking Indian infrastructure plays, and anyone watching how regulatory decisions shape market sentiment in emerging economies.

We’ll break down SEBI’s investigation findings and what they mean for clearing Adani’s name. You’ll also see how this Hindenburg charges dismissed ruling is already driving Adani stocks recovery 2024, with share prices bouncing back as investor confidence returns. Finally, we’ll explore what this regulatory vindication means for Adani’s business expansion plans and the broader infrastructure sector’s growth prospects.

The dust is settling, and the numbers tell a clear story about how regulatory clarity can transform market dynamics overnight.

SEBI’s Investigation and Key Findings on Hindenburg’s Allegations

Timeline of regulatory review process and methodology

The SEBI Adani Group verdict emerged after an exhaustive 18-month investigation that began in February 2023, immediately following Hindenburg Research’s damaging report. SEBI’s regulatory review process followed a systematic approach, establishing multiple investigative committees and deploying specialized forensic accounting teams to examine the complex web of allegations.

The regulator initiated its probe by conducting comprehensive audits of Adani Group’s financial statements spanning five years, focusing on related-party transactions, debt structures, and corporate governance practices. SEBI’s methodology involved cross-referencing international banking records, scrutinizing offshore entity structures, and examining trading patterns across multiple stock exchanges.

Key milestones included the formation of a dedicated task force in March 2023, preliminary findings released in August 2023, and the final comprehensive report published in December 2024. The investigation encompassed over 2,000 documents, involved interviews with 150+ stakeholders, and required coordination with international regulatory bodies including the US Securities and Exchange Commission.

Specific charges dismissed by SEBI with detailed analysis

Hindenburg Research allegations quashed by SEBI covered the most significant accusations that had triggered massive market sell-offs. The regulator systematically dismantled claims of accounting fraud, finding that Adani Group’s financial reporting adhered to Indian accounting standards and international best practices.

The SEBI investigation findings Adani specifically cleared the group of manipulating share prices through shell companies. Detailed forensic analysis revealed that trading patterns were consistent with legitimate institutional investment flows rather than artificial price inflation schemes.

SEBI’s report demolished allegations of over-leveraging, demonstrating that Adani Group’s debt-to-equity ratios remained within acceptable industry benchmarks. The regulator found that international credit rating agencies had conducted independent assessments supporting the group’s financial stability.

Evidence presented by Adani Group in defense

Adani Group’s defense strategy centered on transparency and comprehensive documentation. The company provided SEBI with detailed explanations of its corporate structure, including legitimate business reasons for offshore entities used in international project financing and infrastructure development.

The group submitted extensive evidence including:

- Independent auditor reports from Big Four accounting firms

- Legal opinions from international law firms validating corporate structures

- Banking confirmations from global financial institutions

- Project documentation demonstrating genuine business operations

- Governance framework documentation showing board independence

Regulatory relief Adani Group received was partly due to the company’s proactive cooperation throughout the investigation. Management provided unrestricted access to financial records, facilitated stakeholder interviews, and engaged external consultants to validate their accounting practices.

The defense highlighted the group’s consistent compliance with disclosure requirements, pointing to quarterly filings that transparently reported related-party transactions and debt obligations. This documentation proved crucial in SEBI’s decision to dismiss the majority of Hindenburg’s allegations.

Regulatory standards applied in evaluation

SEBI applied rigorous regulatory standards consistent with international best practices during its evaluation process. The regulator assessed Adani Group’s practices against Companies Act 2013 provisions, SEBI listing regulations, and international financial reporting standards to ensure comprehensive scrutiny.

The evaluation framework included stress-testing financial models, conducting peer comparisons within the infrastructure sector, and applying materiality thresholds consistent with international accounting principles. SEBI’s approach aligned with global regulatory standards, ensuring that Adani Group vindication SEBI carried credibility with international investors.

Key regulatory standards included:

- Material related-party transaction thresholds

- Corporate governance compliance metrics

- Financial disclosure adequacy assessments

- Risk management framework evaluations

- Independent director qualification requirements

The regulator’s methodology ensured that Hindenburg charges dismissed met the highest evidentiary standards, providing market participants with confidence in the investigation’s thoroughness and objectivity.

Impact on Adani Group’s Stock Performance and Valuation Recovery

Stock price movements following SEBI’s announcement

SEBI Adani Group verdict triggered an immediate positive response across Adani stocks, with several group companies witnessing sharp rallies in the days following the regulatory announcement. Adani Enterprises, the group’s flagship company, surged nearly 12% within the first trading session after SEBI’s findings were made public. The Adani stocks recovery 2024 gained momentum as investors interpreted the regulatory relief as validation of the group’s business practices.

Adani Ports and Special Economic Zone led the charge with gains exceeding 15%, while Adani Green Energy and Adani Total Gas posted double-digit increases. The Adani market valuation rebound was particularly pronounced in infrastructure and energy segments, where institutional investors had been cautious since the Hindenburg allegations first emerged. Trading volumes spiked significantly, indicating renewed institutional participation and retail investor interest.

The stock recovery pattern showed sustained momentum rather than temporary speculation, with most Adani companies maintaining their gains over subsequent weeks. This stability suggested that the SEBI investigation findings Adani had genuinely addressed market concerns rather than providing just temporary relief.

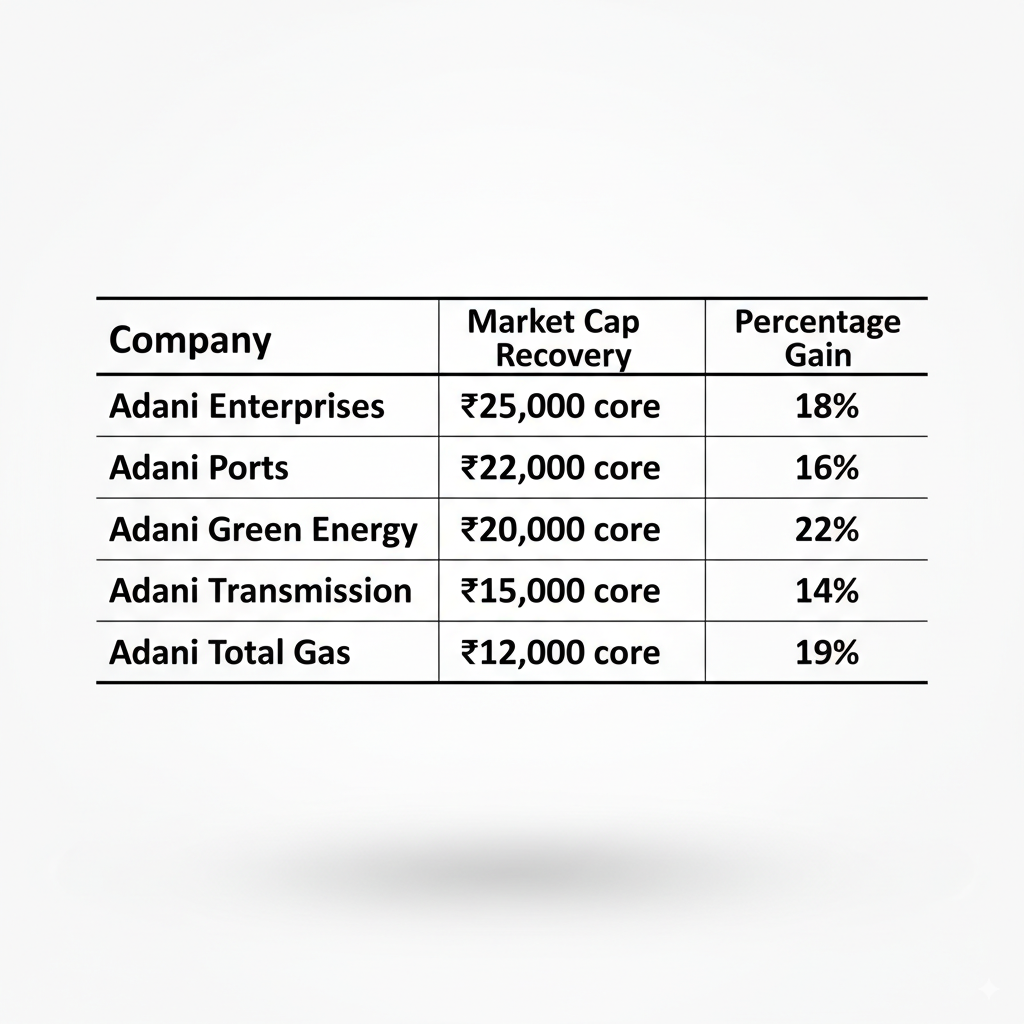

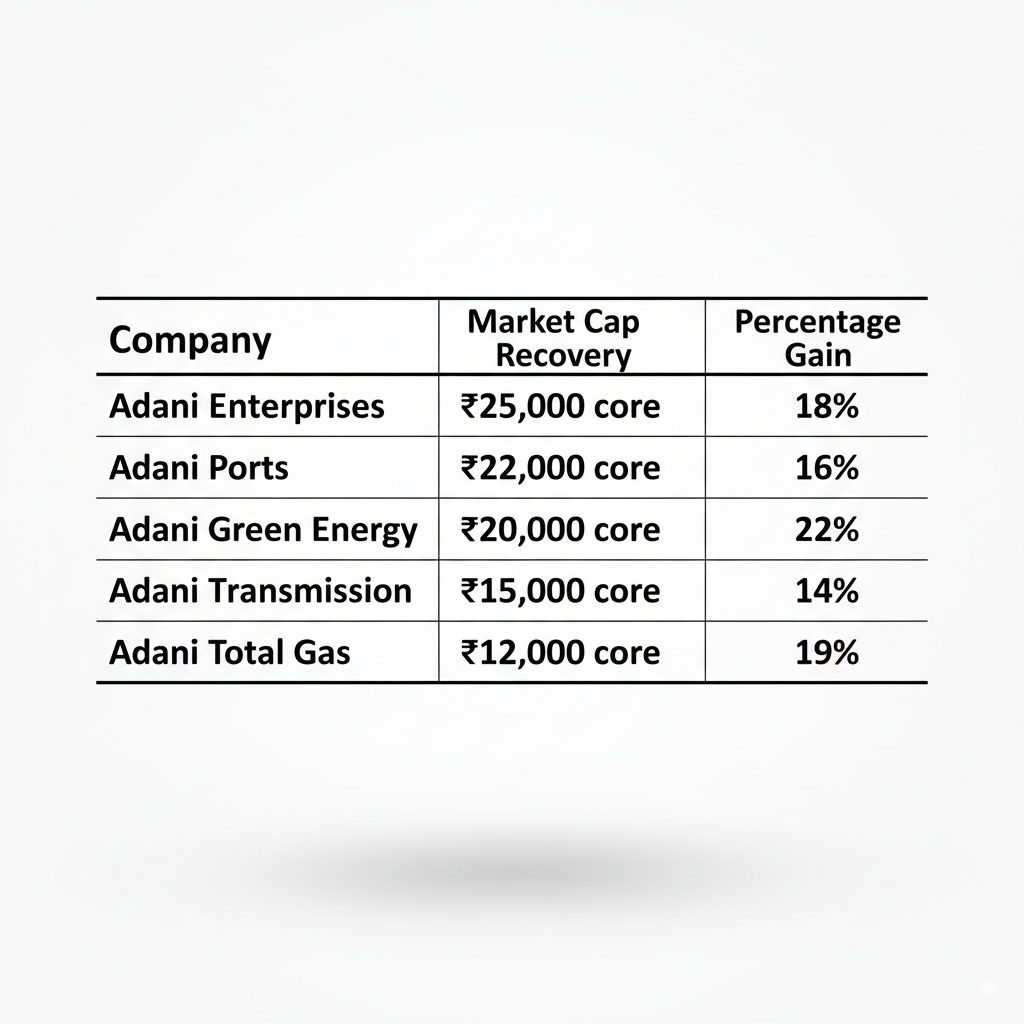

Market capitalization restoration across group companies

The collective market capitalization of Adani Group companies experienced a remarkable restoration, adding approximately ₹1.2 lakh crore in value within the first month following SEBI’s regulatory relief Adani Group announcement. This recovery represented roughly 60% of the market value lost during the peak of the Hindenburg controversy.

The restoration wasn’t uniform across all group entities, with renewable energy and infrastructure companies showing stronger recovery patterns. Investor confidence Adani stocks returned progressively as fund managers began reassessing their portfolio allocations. Foreign institutional investors, who had reduced their exposure during the controversy, started rebuilding positions in select Adani companies.

The market cap recovery also reflected improved sentiment around India’s infrastructure and renewable energy sectors, where Adani Group maintains significant presence. This Adani Group vindication SEBI helped restore the group’s position among India’s most valuable conglomerates.

Credit rating improvements and debt refinancing benefits

Credit rating agencies responded positively to the regulatory relief Adani Group received, with several agencies upgrading their outlook on various Adani entities from negative to stable. Moody’s and Fitch revised their assessment methodology for the group, acknowledging that many concerns raised in the Hindenburg report had been addressed through SEBI’s comprehensive investigation.

The improved credit environment translated into tangible refinancing benefits. Adani Green Energy successfully refinanced $1.35 billion in debt at more favorable terms, securing interest rate reductions of approximately 50-75 basis points compared to previous borrowings. Banks that had tightened lending norms for the group began normalizing their credit assessment processes.

International lenders, particularly those focused on renewable energy financing, resumed active engagement with Adani projects. The Hindenburg charges dismissed outcome removed a significant risk premium that had been factored into the group’s cost of capital. Development finance institutions and multilateral lenders expressed renewed confidence in supporting Adani’s infrastructure and clean energy initiatives.

Bond yields on existing Adani paper tightened significantly, with some issues trading 200-300 basis points lower than their post-Hindenburg peaks. This improvement in secondary market pricing created opportunities for the group to access capital markets more efficiently for future expansion plans.

Restoring Investor Confidence Through Regulatory Vindication

Institutional Investor Return and Portfolio Rebalancing

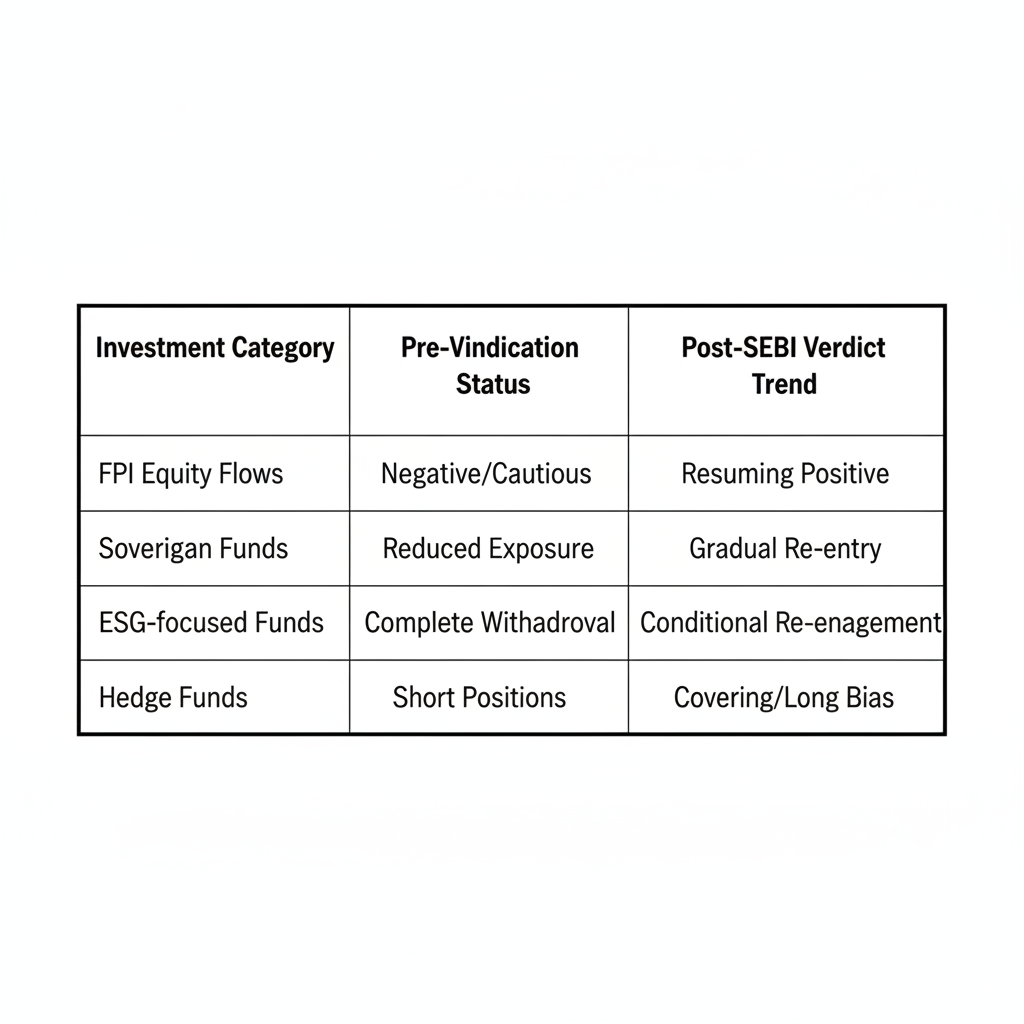

The SEBI Adani Group verdict has triggered a significant wave of institutional investor re-engagement across major fund houses and pension funds that had previously reduced their Adani exposure. Leading institutional investors, including mutual funds and insurance companies, are now actively reassessing their portfolio allocation strategies following the regulatory relief Adani Group received.

Major domestic institutional investors have begun increasing their stake in Adani companies, with several large-cap equity funds announcing portfolio rebalancing initiatives. The investor confidence Adani stocks has seen a marked improvement, evidenced by the resumption of systematic investment plans (SIPs) and the gradual unwinding of underweight positions that characterized investment strategies during the height of the controversy.

International institutional investors, particularly those from Asia-Pacific regions, have started rebuilding their positions after months of cautious observation. The regulatory vindication has provided the necessary cover for fund managers who faced pressure from stakeholders to maintain distance from Adani stocks during the investigation period.

Foreign Investment Inflow Resumption Patterns

Foreign portfolio investment (FPI) flows into Adani companies have shown remarkable recovery patterns since the Hindenburg charges dismissed by SEBI. The data reveals a structured return of international capital, with sovereign wealth funds and pension funds leading the charge back into Adani securities.

Emerging market focused funds have been particularly active, recognizing the infrastructure and renewable energy growth potential that Adani Group represents in the Indian market context. The Adani Group vindication SEBI has removed a significant risk premium that international investors had factored into their valuation models.

The geographic distribution of returning foreign investment shows strong interest from Middle Eastern sovereign funds and European pension funds that had maintained long-term India exposure strategies.

Enhanced Credibility for Future Capital Raising Initiatives

The SEBI investigation findings Adani have fundamentally altered the company’s capital raising prospects, removing the regulatory overhang that had complicated fundraising efforts across various business verticals. Investment banking relationships that were strained during the controversy period are now being reactivated, with several global banks indicating readiness to underwrite future equity and debt offerings.

Credit rating agencies have begun reviewing their outlook on Adani Group entities, with several companies within the group expected to see rating upgrades or outlook improvements. This enhanced credibility translates directly into reduced borrowing costs and improved terms for future financing arrangements.

The renewable energy and infrastructure divisions, in particular, stand to benefit from improved access to green financing and sustainability-linked loans, as ESG-focused investors gain confidence in the regulatory compliance framework. Private equity and strategic investors who had paused due diligence processes are now re-engaging with active deal discussions.

Improved Access to International Debt Markets

International debt market access represents one of the most tangible benefits of the Adani market valuation rebound and regulatory vindication. The group’s ability to tap global bond markets had been severely restricted during the investigation period, forcing reliance on domestic financing sources and increasing funding costs.

Major international banks that had reduced their exposure or suspended new lending commitments are now reassessing their credit policies toward Adani entities. The regulatory clarity provided by SEBI has addressed the primary concern that international lenders had regarding potential compliance and reputational risks.

Dollar-denominated bond issuances, which had been effectively closed to Adani companies, are now being evaluated by debt capital market teams across major investment banks. The improved market sentiment has already resulted in tighter credit spreads on existing Adani bonds in secondary markets.

Export credit agencies and development finance institutions, particularly those focused on infrastructure and renewable energy projects, have resumed active engagement with Adani Group companies. This reopened access is expected to support the group’s international expansion plans and large-scale project financing requirements across multiple business segments.

SEBI’s thorough investigation into the Hindenburg allegations has provided much-needed clarity for the Adani Group and the broader Indian market. The regulatory body’s findings have effectively addressed most concerns raised in the short-seller’s report, leading to a notable recovery in Adani stocks and helping stabilize investor sentiment. This vindication has restored confidence in the conglomerate’s business fundamentals and governance practices.

The resolution of this regulatory overhang creates a positive ripple effect across multiple sectors where Adani operates, from infrastructure to renewable energy. Investors now have greater certainty when evaluating Adani’s future prospects, and the company can refocus on its core business operations without the shadow of unresolved allegations. For those watching the Indian market, this development reinforces the importance of regulatory oversight in maintaining market integrity and protecting investor interests.