Indian shares tumbled on September 24, 2025, as visa curbs targeting IT workers combined with intense global uncertainty, dragging major indices sharply lower and triggering caution across Dalal Street. Steep falls in IT and pharma stocks, reeled under the US-led visa clampdown, compounded selling spurred by mounting fears over oil prices, Fed signals, and geopolitical tensions.

The benchmark Sensex ended down 386 points, or 0.47%, settling at 81,716, while the Nifty 50 lost 113 points, or 0.45%, to close at 25,057. Both indices seesawed throughout the day, registering intraday lows of 81,607 (Sensex) and 25,027 (Nifty), with modest recoveries from bottom but an unequivocal close in the red. Weakness spilled over the broader markets too, with the Nifty Midcap 100 finishing down 1% and Smallcap 100 by 0.70%.

Visa restrictions announced by the US—particularly the hike of H-1B fees to $100,000 for new applications—sent shockwaves through India’s IT sector, which relies heavily on these permits for US-based projects and onsite delivery. Mid-cap IT firms like LTIMindtree, Mphasis, Persistent, and Coforge led declines, dropping 4–4.5% as investors grew wary of delays in US contract awards and ramp-ups. Major blue-chip IT names—TCS, Tech Mahindra, Infosys, Wipro, and HCLTech—also slumped, as clients grow cautious amid tariff and regulatory uncertainty. Pharma shares were caught in the crossfire, with export prospects clouded by tighter US and European administrative controls, particularly affecting visa-dependent contract research and specialty pharma segments.

The impact was felt sector-wide: Nifty IT lost over 3% in recent days, and the Nifty Pharma index continued its downswing. Other services sectors with global orientation—outsourcing, consulting, healthcare, and education—also came under pressure. With stricter rules from the US, Ecuador, certain EU states, and even Bangladesh tightening access visas for Indian service professionals and patients, industry leaders warn of potential revenue disruptions lasting into FY26.

FMCG emerged as the only sector in the green, up 0.18%, buoyed by consumer resilience and defensive buying. Banks and autos ended mixed, vulnerable to the spillover from lower IT spending and weakening sentiment. Among index movers, Tata Motors (-3%), Bharat Electronics, Adani Enterprises, Wipro, Jio Financial Services, Bajaj Auto, Hero MotoCorp, and Tech Mahindra ranked among the top losers. Meanwhile, HUL, Nestle, NTPC, JSW Steel, and Power Grid managed gains, safeguarding their defensive reputation amid the sell-off.

Market mood reflected turbulence abroad. The hawkish stance of the Federal Reserve, still wary of inflation, has put global risk assets under pressure. Persistent volatility in Brent crude, recently above $95/bbl, stoked inflation fears and spurred selling in emerging market equities. Escalating geopolitical stresses—from Middle Eastern hostilities and Asian border admins to talks by President Trump on tighter trade and defence policies—kept investors unnerved.

Overseas investors turned net sellers, pulling ₹3,551 crore out of Indian equities, with bulk sales concentrated in IT, banking, and auto shares as global hedge funds reassessed exposure amid heightened US policy risk. Domestic institutions, notably mutual funds and insurance firms, provided balancing support—purchasing ₹2,670 crore net—but could not fully stem the outflow. These flows magnified the bearish undertone, as FPIs trimmed bets on IT due to visa bottlenecks and uncertain quarterly outlook.

Technically, Nifty is trading in a crucial 25,000–25,150 support range, with immediate resistance at 25,400 and 25,500. A sustained breach below the 25,000 mark signals further downside, possibly extending correction towards 24,950 or below, while robust support above 25,000 could eventually trigger a technical bounce. Sensex similarly shows strong support at the 82,000 psychological level, with derivative positioning suggesting mixed action at higher zones. Long-term uptrend remains intact unless these support zones are decisively broken, but traders should monitor for possible breakdowns on increased volatility.

Expert commentary from economists and market strategists (placeholder):

- “The US visa fee hike is a short-term jolt for India’s IT sector, but the industry has capacity to adapt by shifting more delivery offshore.”

- “Geopolitical uncertainty will continue to prompt risk-off moves; investors should stay agile and diversify portfolios.”

- “Sector rotation is visible, with FMCG acting as safe haven amidst global shocks.”

What does this mean for retail investors? In simple terms, today’s dip reflects a mix of overseas policy moves, especially the US visa clampdown, and worries about the global economy. Investors with IT, pharma, and global sector stocks may see portfolio declines in the near term, but widespread panic selling is not advised—these corrections often offer opportunities for disciplined re-entry once the dust settles.

Quick Investor Checklist:

- Track updates on visa and immigration policy, including US, EU, and Asia moves targeting Indian talent.

- Monitor Q2 and Q3 IT sector earnings, especially exposure to onsite revenue and global client contracts.

- Watch for signals from the US Federal Reserve and G7 policy meetings.

- Review FPI flows and DII support metrics for clues on foreign/domestic investor sentiment.

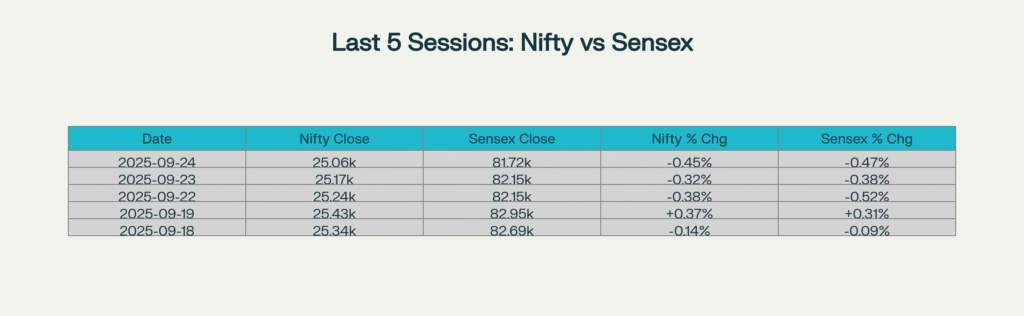

Mini Data Table: Nifty 50 vs Sensex Last 5 Sessions Performance

[Nifty 50 vs Sensex: Last 5 Sessions Performance]

Investor Takeaways:

For retail investors and corporates, short-term caution is warranted. Limit leveraged positions in globally exposed sectors (IT, pharma, auto); wait for clarity on visa/immigration policy updates and earnings before deploying fresh capital. FMCG and select defensives may offer insulation, but sector rotation and volatility are likely to persist until global cues stabilize. Long-term investors should remember India’s resilience—rewriting delivery models, upskilling talent, and strengthening domestic demand can help offset near-term shocks over time.