GRSE Wins $62.44M Hybrid Vessel Contract; Ola Electric Ramps Up Festive Production as Investor Interest Builds

The twin worlds of defence shipbuilding and electric mobility rarely intersect, but two Indian pioneers – Garden Reach Shipbuilders & Engineers Ltd (GRSE) and Ola Electric – are demonstrating how Make‑in‑India champions can power very different, but equally important, frontiers. Over the last week GRSE announced a significant export contract for hybrid multi‑purpose vessels (MPVs) and Ola Electric revealed an aggressive production ramp‑up ahead of the festive buying season. Together, these updates underline the vitality of India’s defence industrial base and the growing momentum in the electric two‑wheeler market.

Garden Reach’s $62.44 million order

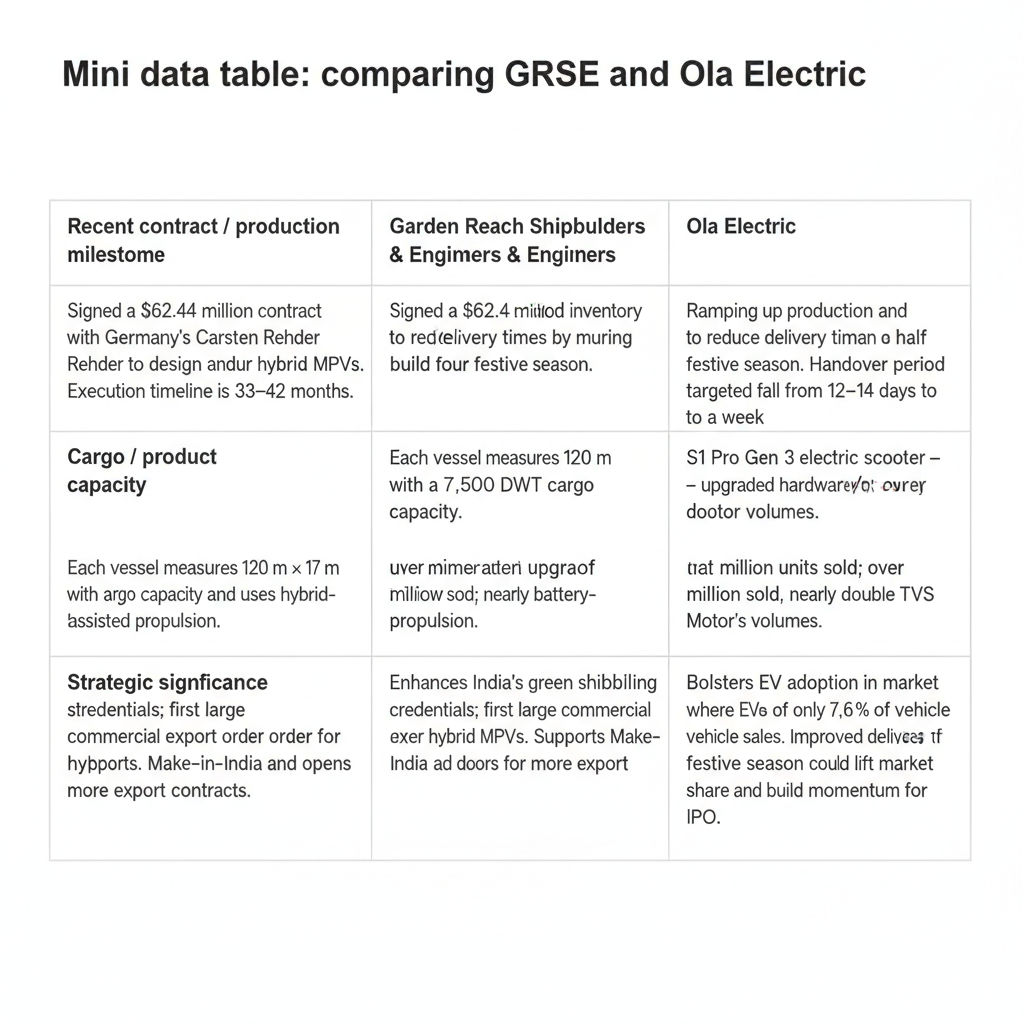

Kolkata‑based GRSE has signed a contract with Hamburg‑based Carsten Rehder Schiffsmakler und Reederei GmbH & Co KG to design, build and deliver four hybrid multi‑purpose vessels with a total value of USD 62.44 million. According to the regulatory filing, the contract must be executed within 33–42 months, is not a related‑party transaction and does not involve promoter interests Each vessel will be 120 metres long and 17 metres wide with a draft of 6.75 metres and can carry 7,500 dead‑weight tonnes (DWT). They will use hybrid propulsion with a battery‑assisted system, allowing for low‑emission operations and improved fuel efficiency; the design can handle wind‑turbine blades and other renewable‑energy cargo. GRSE emphasised that this is an export order that advances its “Make in India, Make for the World” vision and noted that steel‑cutting for the first ship occurred in April 2025【

Why hybrid MPVs matter for India’s naval industry

Hybrid multi‑purpose vessels are versatile ships designed for cargo, offshore support and renewable‑energy logistics. The inclusion of battery‑assisted propulsion reduces emissions and fuel consumption while providing redundancy for critical operations. For India, these vessels represent a leap in maritime technology and support the Indian Navy’s aspiration for greener, self‑reliant platforms. GRSE’s program is also significant because it is one of the first large commercial exports from an Indian shipyard; the company’s history spans building India’s first warship INS Ajay (1961), delivering over 100 warships and exporting patrol vessels to Mauritius. The new contract reaffirms India’s reputation as a competitive shipbuilder able to deliver complex vessels to European customers.

Financial and market impact on GRSE

The order adds more than ₹5.2 billion (at ₹83/USD) to GRSE’s already healthy order book and provides revenue visibility over the next three years. The stock reacted positively to the announcement: on 22 September 2025, GRSE shares traded around ₹2,668, up 2.4 % for the day, with the trade ticker on investment platform Trendlyne highlighting the “Order Win” news. The company’s market capitalisation stood around ₹30,567 crore and the contract underscores its ability to tap global markets. Analysts note that the order diversifies GRSE’s revenue away from cyclical defence orders and positions the yard for future export opportunities, particularly if buyers exercise options for additional vessels. Investors will look for timely execution and margin management because hybrid vessels involve new technology and complex supply chains.

Expert view on GRSE

Defence analyst Radhika Saxena of Maritime Strategies observed that “this order extends GRSE’s commercial footprint beyond naval platforms and validates its investment in green shipbuilding technology. Hybrid propulsion is still a niche segment, and executing four vessels for a demanding European owner will help the yard develop systems integration skills that are transferable to military programs.” Saxena believes the successful delivery could lead to follow‑on orders, supporting GRSE’s earnings growth.

Ola Electric’s production push for the festive season

While GRSE secures orders on the high seas, home‑grown EV maker Ola Electric is preparing for India’s roads. A report in The Economic Times/Press Trust of India said the company is ramping up production and inventory to cut vehicle delivery timelines by more than halfHandover periods for its S1 scooters have been around 12‑14 days, but management wants to halve that to meet the surge in demand around Navratri and Diwali. Sources told the newspaper that delivery speed will be the differentiator, and customer experience improvements are a key priority. Ola has sold over one million electric scooters, almost twice the volume of its closest rival TVS Motor. Its S1 Pro Gen 3 – with upgraded hardware and software – remains the top‑selling model, accounting for most deliveries. Rather than offering deep discounts like some competitors, Ola is focusing on inventory availability and profitability

EV sector context

India’s electrification push has accelerated, but penetration is still low. According to a 2025 NITI Aayog report, EV sales in India climbed from 50,000 units in 2016 to 2.08 million in 2024, while global EV sales grew from 918,000 to 18.78 millionL172】. EVs made up about 7.6 % of India’s total vehicle sales in 2024, far below the government’s 30 % target for 2030】. The report notes that India is performing well in electric two‑wheelers and three‑wheelers, but adoption of electric cars and buses remains slow. This context underscores why Ola Electric’s ramp‑up ahead of the festive season matters: two‑wheelers account for the majority of India’s vehicle sales, and capturing festival demand can meaningfully increase EV penetration. Government incentives under the FAME II scheme and state subsidies continue to make electric scooters more affordable, while rising fuel prices and urban pollution push consumers toward cleaner mobility.

Ola Electric’s IPO and investor outlook

Ola Electric filed a draft prospectus last year to raise funds through an initial public offering, which would be India’s first listing by a pure‑play EV manufacturer. Industry sources suggest the IPO could value the company at $4–5 billion and raise capital to scale its 2 million‑unit annual capacity and invest in cell manufacturing. The company has said proceeds will fund capacity expansion, battery production and sales network growth. Analysts note that strong festive sales and improved delivery metrics could bolster investor sentiment ahead of the IPO. Early investors such as SoftBank have already trimmed their stakes, and the offering will test market appetite for high‑growth but still loss‑making EV start‑ups. Investors should monitor subscription data, listing valuations and use of proceeds as the offering timeline nears.

Expert view on Ola Electric

Automotive consultant Vikram Menon from eMobility Insights remarked that “Ola Electric’s decision to double inventory and halve delivery timelines before the festive season shows confidence in demand. It also indicates that the company has addressed production bottlenecks that led to long waiting periods last year. With over a million units sold, Ola has scale, but the real challenge will be maintaining quality and service as volumes surge. Investors eyeing the IPO should watch how the company manages working capital and service infrastructure.”

Industry‑wide implications: defence, EVs and green growth

The juxtaposition of GRSE’s hybrid vessel deal and Ola Electric’s festive ramp‑up reflects India’s broader industrial transformation. In defence, the government’s focus on indigenisation and export is bearing fruit; state‑owned shipyards are moving from licence production to advanced design and hybrid technology. The hybrid MPVs will not only support renewable‑energy logistics but also enhance India’s credibility as a green maritime supplier. Meanwhile, the EV sector is tackling the world’s largest two‑wheeler market and demonstrating that Indian start‑ups can build scale. The NITI Aayog report urges a shift from incentives to mandates and notes that EV penetration must rise dramatically to meet the 2030 target. Ola Electric’s production push signals industry confidence, while the upcoming IPO could catalyse more capital for EV manufacturing and battery supply chains.

Quick investor checklist

Retail investors following these stories should watch a few critical indicators:

- Contract execution and margins at GRSE – timely delivery of the four hybrid MPVs and any options for additional vessels will determine profitability.

- Order book visibility – the $62.44 million export order extends GRSE’s revenue pipeline; monitor announcements of further export deals or Indian Navy orders.

- Festive demand and delivery metrics for Ola Electric – watch whether delivery timelines indeed fall below a week and whether S1 Pro Gen 3 remains the bestseller【257044181656692†L39-L97】.

- IPO timeline and valuation – track regulatory filings, subscription trends and final pricing; an attractive valuation with strong fundamentals could provide a long‑term opportunity.

- Policy signals – changes to FAME incentives, battery production policies or defence procurement guidelines will influence both companies.

Retail watch: why this matters

For retail investors, GRSE’s hybrid vessel contract and Ola Electric’s festive‑season push are signals of where India’s industrial economy is headed. On one side, GRSE is monetising decades of naval expertise to win export orders and advance green maritime technology. Successful execution could boost profits and prove that Indian shipyards can compete globally. On the other side, Ola Electric is capitalising on increasing EV demand and showing that domestic manufacturing can scale quickly. As India’s EV penetration climbs from 7.6 % toward the 30 % goal, leaders like Ola will be pivotal. Investors should temper enthusiasm with due diligence: hybrid vessels involve execution risk, and EV startups must manage service quality and cash flow. Nonetheless, both stories underscore the long‑term potential of India’s defence and green mobility sectors.

Summary box

The past week offered a snapshot of India’s evolving industrial landscape. GRSE’s $62.44 million contract for hybrid multi‑purpose vessels underscores the shipyard’s technological advancement and reinforces the country’s ambition to become a global defence exporter. Ola Electric’s decision to ramp up production and inventory ahead of the festive season reflects growing consumer appetite for electric two‑wheelers and the company’s readiness for the public markets. For investors, these developments signal opportunities and challenges: the need to track execution and policy shifts, but also the promise of a greener, self‑reliant economy.