Adani Group has announced plans for a new initial public offering (IPO) in its utilities business, a strategic move set to expand both its footprint and India’s bustling capital markets pipeline. According to market sources and company disclosures, the IPO is designed to unlock value from Adani’s robust infrastructure holdings within the utilities sector. Industry estimates peg the potential issue size at upwards of $2 billion, and if successful, the listing could rank among the largest Indian IPOs for 2025, signaling continued regional and global investor appetite for high-growth infrastructure plays.

The group’s utilities vertical reportedly includes power transmission and distribution assets, smart metering, grid management, and advanced energy solutions operated primarily under Adani Energy Solutions Ltd (AESL). While official details on the issue size are still pending, preliminary statements cite reputed merchant bankers such as SBI Capital, Axis Capital, and JP Morgan in charge of book building and regulatory filings. NSE and BSE filings will outline specifics in the coming weeks, as the company works through SEBI’s listing process and investor roadshows.

Adani’s utilities business has rapidly scaled over the past few years, emerging as one of India’s leading market participants in transmission and distribution. Financials for FY25 show AESL managing over ₹1 lakh crore in assets, powering large sections of India’s national grid and city infrastructure. Revenues have moved up steadily, with a 17% CAGR over five years; margins benefit from operational scale and government incentives. As India’s demand for electricity grids, smart cities, and renewable integration surges, the sector’s relevance for domestic and foreign investors is at an all-time high. AESL itself drives forward-looking investments in smart metering and green cooling, positioning Adani to capture future growth in sustainable infrastructure.

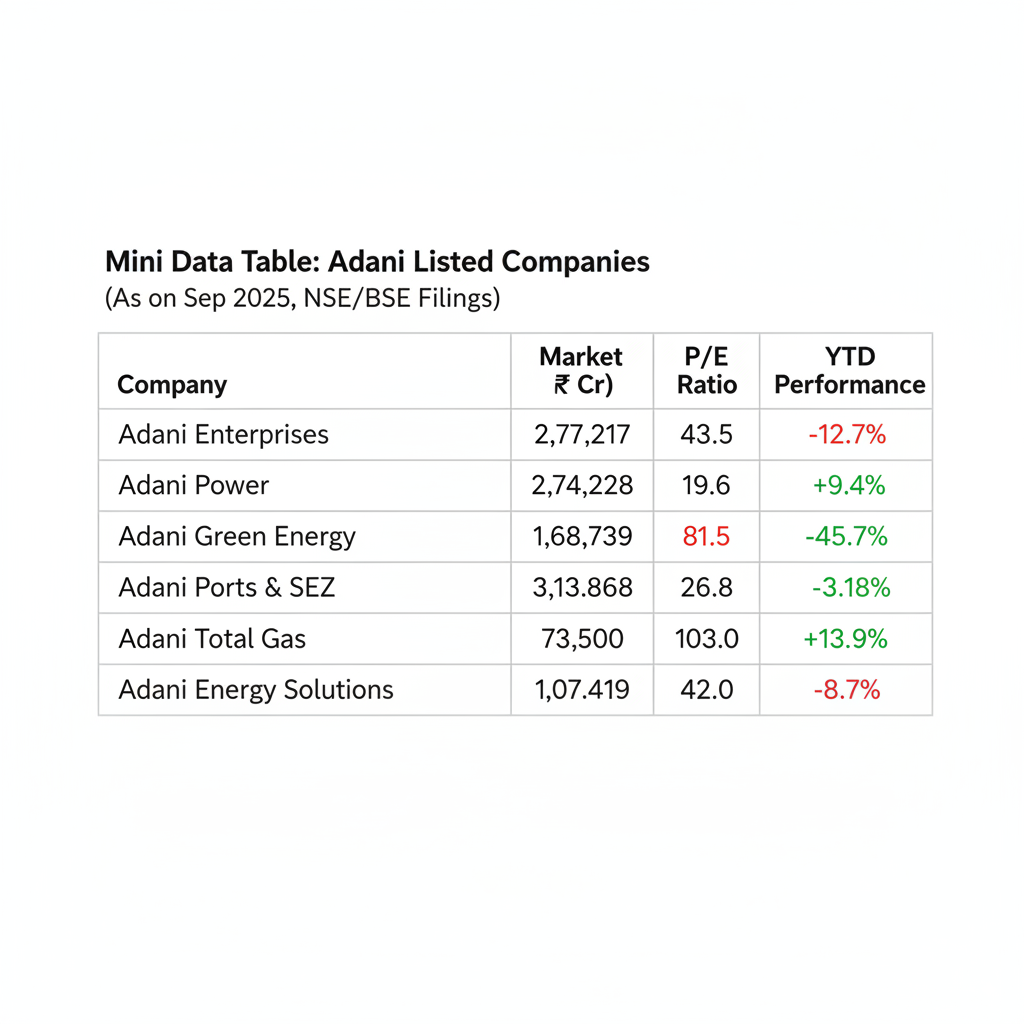

For the Adani Group, this IPO fits neatly within an aggressive portfolio growth strategy. Adani already commands some of the largest listed companies in Indiac, Adani Power, Adani Green Energy, Adani Ports & SEZ, Adani Total Gas, Ambuja Cements, ACC, and Adani Wilmar. Adding utilities to this mix will broaden the group’s exposure and offer new ways for retail and institutional investors to participate in India’s infrastructure expansion. The move to list utilities follows ongoing resilience across other divisions, including Adani Power’s recent record quarterly EBITDA and Adani Ports’ solid financials.

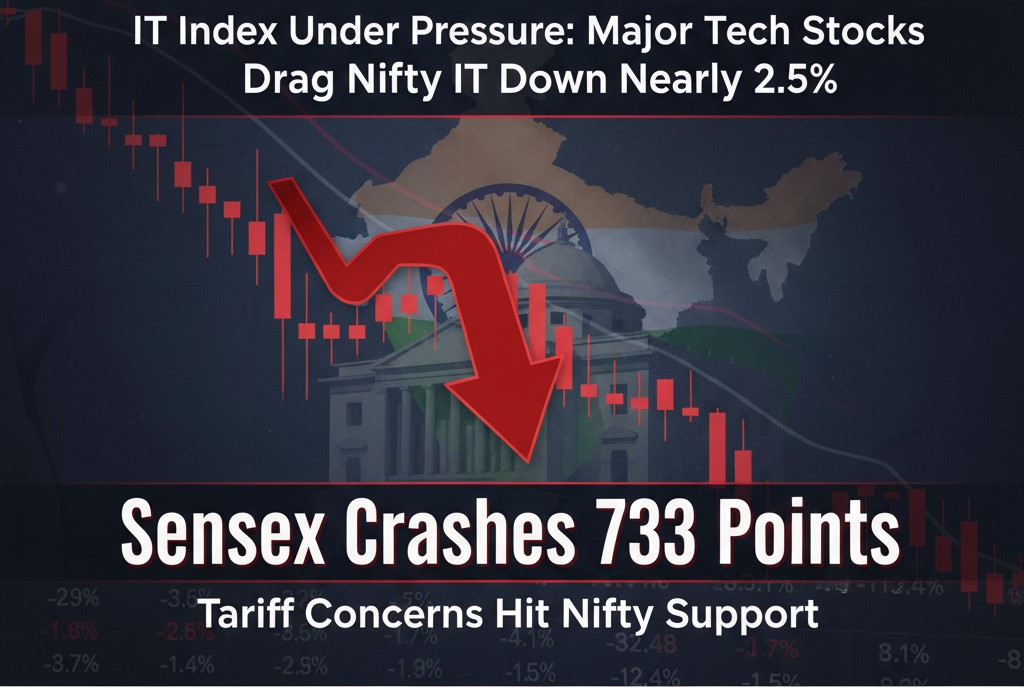

The new utilities IPO adds significant momentum to India’s capital market pipeline, which has already been strengthened this year by marquee listings across sectors. Policy reforms from SEBI, including easier foreign investor entry and flexible float requirements for large IPOs, facilitate greater capital formation and broaden market participation. With a projected $60 billion investment in power over the next decade, Adani’s utilities float is expected to deepen investor choices and boost the liquidity available to Indian infrastructure projects. For retail investors, the listing promises opportunities to invest in a critical sector during a period of rapid modernization, though it comes with complexity that requires informed decision-making.

Investor sentiment has generally been constructive in the run-up to the IPO announcement. Retail investors, institutional funds, and global participants are attracted by the group’s financial heft, high growth rates, and sector leadership. Since SEBI’s recent clearance of Adani Group on historical disclosure issues, the regulatory overhang has faded, bringing stabilization and renewed optimism for Adani stocks across exchanges. Still, some cautious voices persist, reminding investors to scrutinize debt levels and valuation multiples. Global funds continue to monitor regulatory developments and the sustainability of India’s infrastructure policy direction.

Valuation-related risks loom large for retail investors considering the utilities IPO. The Adani Group is known for leveraging financial engineering and debt-funded expansion, which fuels growth yet raises questions over long-term financial sustainability. Upcoming IPO documents will detail the group’s debt/equity ratios, cash flow coverages, and contingent liabilities. Utilities, though defensive, face regulatory scrutiny and periodic shifts in tariff, subsidy, and government oversight. Furthermore, with valuations for some Adani stocks already trading at premium multiples, new investors should compare sector P/Es and benchmark against listed peers before subscribing.

Analyst opinions on the utilities IPO are divided but insightful. According to an Indian brokerage research head: “Adani’s utilities IPO presents a strong play on India’s infrastructure building and transmission capacity. Retail investors can benefit if pricing is reasonable and debt risks are mitigated.” Another market strategist counters with caution: “The Adani Group’s rapid expansion and debt accumulation are well-known. We recommend close attention to IPO prospectus details, especially capital allocation strategies.” International brokerage commentary highlights India’s long-term infrastructure story but advises vigilance against sectoral regulatory changes or shifts in global interest rates.

The technical and strategic timing of this IPO is deliberate. Renewed appetite for infrastructure—spurred by government push on modern power grids, smart cities, and renewables—aligns with Adani’s sector strengths. By launching its utilities business now, the group leverages recent regulatory clarity from SEBI, persistent demand for sustainable assets, and growing retail interest in infrastructure. NSE and BSE filings, as well as roadshows, will stress the stability, visible cash flows, and India-centric growth offered by utilities in Adani’s portfolio.

For retail investors, the IPO is both an opportunity and a test of diligence. It allows direct exposure to the utility infrastructure boom but requires a pragmatic approach. Here’s a quick investor checklist: track the final issue size and institutional participation, benchmark valuations vs listed peers, monitor grey market premium signals, and scrutinize debt and leverage ratios in prospectus. Prospective subscribers should also watch for regulatory signals—SEBI’s final approval and any changes in market sentiment due to global events or sector news.

Retail Watch: For small and first-time investors, the Adani Group utilities IPO could be an accessible way to invest in India’s infrastructure growth. Utilities are considered defensive; they’re less sensitive to economic cycles than sectors like autos or tech. However, high debt and fluctuating government tariffs remain risks. Reviewing SEBI IPO prospectuses, checking market cap vs sector norms, and watching for grey market trends will help retail investors make informed decisions.

In summary, the Adani Group’s utilities IPO stands to reshape both its portfolio and the Indian IPO landscape. The offering will deepen the capital markets pipeline, diversify Adani’s listed assets, and give retail investors new choices during India’s infrastructure boom. Persistent risks—especially around valuations, debt, and regulatory changes—emphasize the need for careful analysis, but regulatory clarity and market momentum provide a strong tailwind. For retail investors, tracking prospectus details, market signals, and sector trends remains key to unlocking opportunity in what could become a bellwether listing for 2025.