The Nifty 50 index ended higher today as robust momentum in banking stocks, led by Kotak Mahindra Bank and Axis Bank, drove the market’s gains. Both lenders delivered standout performances amid a wave of positive sentiment and strong financial reports, fueling a notable banking sector rally that lifted broader indices and caught the attention of retail investors and analysts alike.

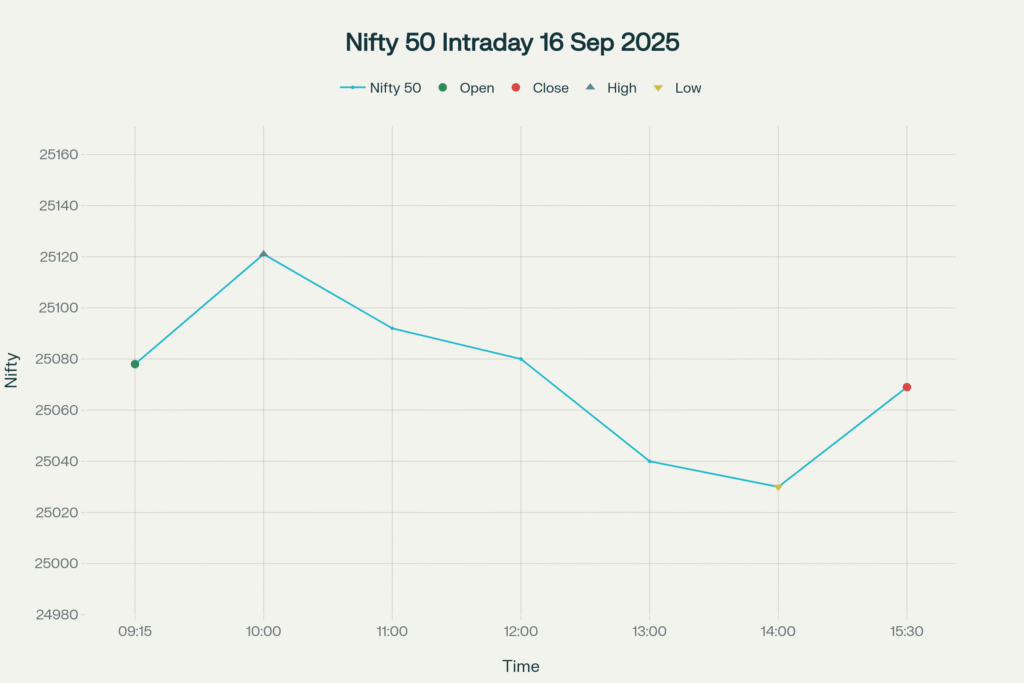

Banking names dominated today’s session, with Kotak Mahindra Bank closing at ₹1,998.90—up 1.43%—and Axis Bank finishing at ₹1,120.90, a 1.49% increase. These gains far outpaced much of the broader market, underlining the strength and renewed optimism among private lenders. The Bank Nifty index itself advanced 0.57% to close at 54,887.90, easily outperforming the Nifty 50 and Sensex, which settled at 25,069.20 (+0.18%) and 81,785.74 (+0.15%) respectively. Intraday, the Nifty recorded a high of 25,121.00 and a low of 25,048.75—highlighting volatility but sustained buying interest near support zones

Kotak Mahindra Bank’s outperformance stemmed from its consistently strong quarterly results. In Q1 FY26, the bank’s net interest income climbed 6% year-on-year to ₹7,259 crore, and its loan book expanded 14% year-on-year to touch ₹4,44,823 crore. Despite higher provisions, the lender’s asset quality remained excellent, with gross NPAs trending below sector averages. Management commentary reiterated Kotak’s focus on retail loan growth and prudent risk management, helping cement investor confidence in the bank’s long-term trajectory. These positives have kept its valuation premium intact, even as the broader sector faces rate-related uncertainties.

Axis Bank’s rally was also supported by impressive financial strength and operational performance. In Q2 FY25, net interest income jumped 9% year-on-year to ₹9,712 crore, while net profit registered an 8% growth at ₹4,443 crore. The bank’s CASA ratio improved to 46%, boosting margins and demonstrating continued traction in low-cost deposit growth. Axis further benefited from stable asset quality, with declines in overall provisions, and a leading digital banking push, as reflected in rapidly growing mobile app engagement. These factors propelled optimism among institutional investors, with Axis Bank’s strategic focus on digital and operational levers resonating as key differentiators in today’s session.

The strength in Kotak Mahindra Bank and Axis Bank translated across the banking sector, supporting the Bank Nifty index and lifting overall market sentiment. While top private lenders such as HDFC Bank, ICICI Bank, and SBI also posted gains, their moves were more muted compared to the rally in Kotak and Axis. This sectoral outperformance came at a time when IT and auto stocks witnessed relatively subdued action, and pharma traded flat, highlighting a clear rotation of investor flows toward financials.

Institutional flows provided further evidence of bullish sentiment toward banking stocks. NSDL and CDSL data showed net FPI inflows of ₹2,470 crore into financials, complemented by domestic institutional investor (DII) buying of ₹1,900 crore for the fortnight ending September 15. These flows reflected continued confidence in the growth trajectory of Indian banks, especially amid expectations of monetary easing and supportive policy actions from the Reserve Bank of India, which recently enacted a repo rate cut and lowered the cash reserve ratio (CRR).

Technical indicators reinforced the bullish bias in today’s session. Nifty found key support at 24,950 and faced resistance near 25,150, while Bank Nifty’s support and resistance were mapped at 54,500 and 55,250 respectively. The Nifty’s RSI hovered around 57, and its MACD remained firmly bullish—suggesting strong buying momentum, with both the 50-DMA and 200-DMA acting as proximate supports.

Expert commentary from market analysts reflects the upbeat tone: “Kotak Mahindra Bank’s strong credit growth and healthy margins underpinned today’s rally,” noted one banking sector expert. A leading fund manager added, “Axis Bank continues to benefit from improving asset quality and robust CASA growth, setting it apart in today’s market.” Technically, “Bank Nifty has immediate support at 54,500 and resistance at 55,250,” said a technical analyst with a brokerage, pointing out potential levels for traders to monitor.

For retail investors and traders, today’s moves point to several actionable insights. For short-term traders, it is crucial to track Bank Nifty levels for possible follow-through buying in Kotak Mahindra Bank and Axis Bank. Keeping a close watch on upcoming RBI policy signals and the flow of institutional money will help identify the next market catalyst. For long-term investors, robust earnings growth and improving asset quality should be weighed against high sector valuations. Risks include a possible reversal in monetary policy, tightening regulations, and broader macroeconomic uncertainties.

In sum, the leadership shown by Kotak Mahindra Bank and Axis Bank was pivotal in sustaining Nifty 50 and broader market momentum. Their superior financial performance and operational resilience provided positive signals for sector rotation, and the banking sector looks set to remain the engine of further gains in the days ahead. With continued institutional flows and robust fundamentals, private lenders—particularly Kotak and Axis—are attracting heightened attention from investors searching for stability and earnings growth within the market’s current landscape.