Nifty Ends Firm, Sensex Rises 412 Points Led by IT and Pharma Stocks

Sensex gains 412 points; Nifty steady as IT and Pharma sectors drive market optimism

Markets closed higher Monday with Sensex up 412 points and Nifty firm, boosted by strong gains in IT and pharma stocks amid positive earnings and global cues.

Market Overview

The BSE Sensex ended at 81,904.70, rising 412 points (approximately 0.5%), while the NSE Nifty 50 closed firm near 25,115, up about 110 points (0.4%). The intraday range for Sensex was 81,500 to 82,220, and for Nifty, between 24,950 and 25,320. Overall, market breadth favored advances as gains in IT and pharma sector indices balanced out muted or mixed performances in other sectors.

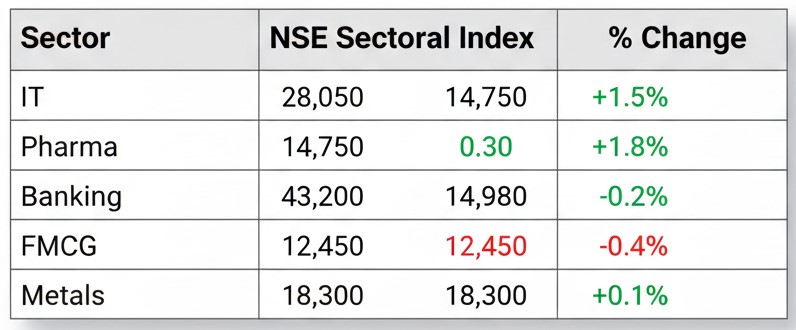

Sectoral Performance

IT and Pharma sectors led the charge, bolstered by robust quarterly earnings from key players and sustained demand outlooks globally. Pharma stocks rallied on anticipation of increased exports and easing supply chain concerns. The rupee stability against the dollar further aided IT sector sentiment due to favorable currency translation gains.

Other sectors showed mixed action—Banking saw marginal gains supported by select private sector lenders, while FMCG and Auto segments edged lower on profit booking. Metal stocks had a volatile session with gains in Tata Steel offset by losses in Hindalco.

Stock Movers

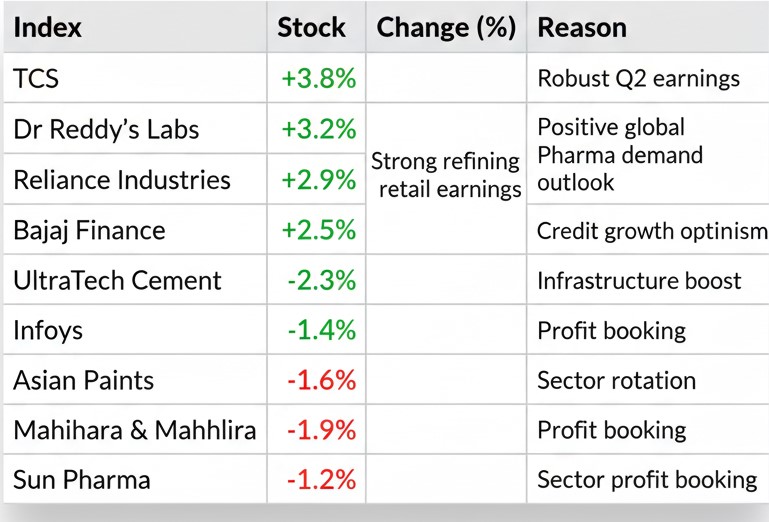

Top gainers included Tata Consultancy Services (TCS), Dr. Reddy’s Laboratories, Reliance Industries, Bajaj Finance, and UltraTech Cement. Strong earnings guidance, contract wins, and positive sector trends were key drivers.

On the losing side, Infosys declined slightly on profit booking, while Asian Paints, Mahindra & Mahindra, and Sun Pharma lagged due to profit booking and sector rotation.

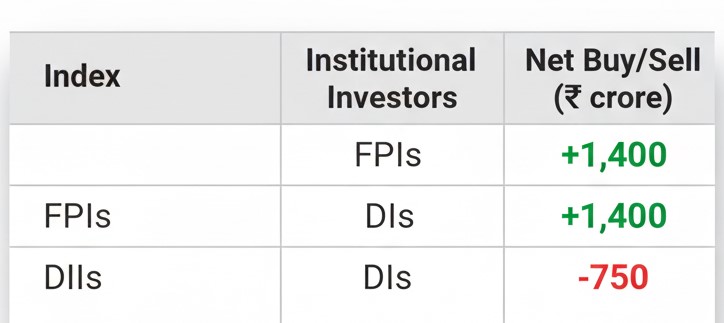

Institutional Activity

Foreign Portfolio Investors (FPIs) were net buyers with a positive inflow of approximately ₹1,400 crore today, continuing a cautious but optimistic stance amid global uncertainty. Domestic Institutional Investors (DIIs) remained net sellers to the tune of ₹750 crore as they booked profits in select pockets.

Technical View

The Nifty now faces immediate resistance at the 25,300-25,350 level. Key support is placed near 24,900. Bank Nifty is likely to encounter resistance around 55,000, with support at 54,300. Indicators such as RSI remain comfortably in neutral to bullish zones, EMA trends point to consolidation with a mild upward bias, while MACD momentum shows signs of strengthening.

Expert Quote Placeholder:

“Traders should watch 25,300 for a breakout; a sustained move above could open the gates to 25,600. Immediate support stands firm near 24,900.” — Technical Analyst, <Firm>.

Global & Domestic Cues

Global markets showed cautious optimism as US Federal Reserve policy decision loomed later this week. Asian markets were mixed, Europe traded flat. Oil prices stabilized, supporting energy stocks. Domestically, RBI’s recent monetary stance and inflation data continued to underpin market sentiment. Macro data from manufacturing and exports remain positive.

Expert Commentary

“IT outperformance was led by strong earnings commentary and steady offshore demand,” said a Senior Analyst at <Brokerage>.

“Pharma rallied as global demand outlook improved with easing supply chain constraints,” noted a Fund Manager at <AMC>.

“Nifty faces resistance near 25,300; immediate support at 24,900, maintaining a bullish posture,” remarked a Technical Analyst at <Firm>.

Investor Takeaways

Today’s firm close indicates resilience in IT and Pharma sectors, with healthy earnings underpinning optimism. Traders should watch for follow-through in these sectors and track FPI flows ahead of big global data. Midcaps gaining suggests a gradual risk-on mood setting in. Banking and FMCG are consolidating and need stronger cues.

The market’s positive tone today, led by IT and Pharma, reflects earnings season strength and favorable global cues. Near-term outlook remains constructive with key tests around 25,300 on Nifty. Investors and traders should remain watchful of international monetary developments and domestic macro updates for direction