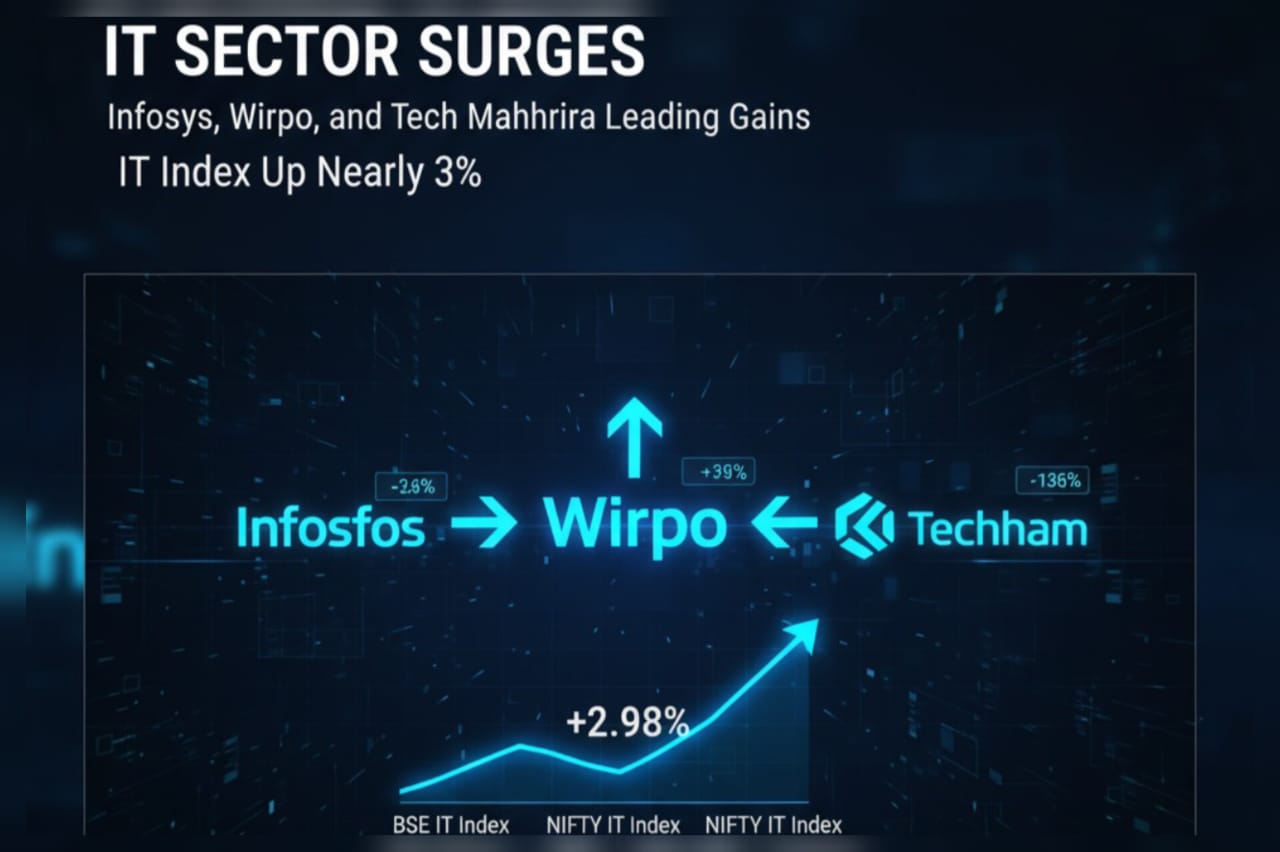

A rebound in the technology sector, spearheaded by giants like Infosys and Wipro, fuels a broader market upswing, signaling renewed investor confidence.

Indian equity markets witnessed a significant surge, with the benchmark Nifty 50 and Sensex indices posting strong gains, primarily driven by a robust performance from the Information Technology (IT) sector. The Nifty IT index climbed nearly 3%, marking its best single-day performance in recent times. This rally was fueled by positive sentiment surrounding the sector’s resilience and a brighter global economic outlook. The gains were broad-based, with major players like Infosys, Wipro, and Tech Mahindra leading the charge, pulling the overall market higher. The IT sector’s resurgence comes at a crucial time, offering a much-needed boost to investor sentiment amidst persistent global macroeconomic uncertainties. This upswing suggests that investors are pricing in a recovery in key Western markets, which are the primary revenue sources for Indian IT firms.

Sectoral Analysis

The IT sector’s rally was the most prominent story of the day. The Nifty IT index’s impressive gain was a powerful statement of renewed faith in India’s tech engine. This performance contrasted with other key sectors, which showed a mixed bag of results.

IT Sector: The IT surge was driven by expectations of a pick-up in client spending, particularly in the United States and Europe, the largest markets for Indian IT companies. After months of cautious spending and project delays, analysts are now forecasting a potential revival in demand for digital transformation, cloud computing, and AI-driven services. This sentiment was reflected in the strong performance of major IT stocks, with the index as a whole outperforming the broader market.

Banking & Financial Services: The Nifty Bank and Nifty Financial Services indices ended the day with modest gains, reflecting a sense of stability but lacking the strong momentum seen in IT. Private sector banks showed resilience, buoyed by healthy credit growth data and stable asset quality. However, public sector banks were mixed, holding back the overall index from a sharper rise. The sector continues to grapple with the Reserve Bank of India’s (RBI) cautious stance on interest rates, which keeps lending margins under pressure.

Automobile Sector: The Nifty Auto index showed a flat-to-marginally-positive trend. The sector’s performance was a mixed bag, with some segments like passenger vehicles showing strong sales figures, while others, particularly commercial vehicles and two-wheelers, faced headwinds from rising input costs and lukewarm rural demand. The performance was largely stock-specific, with companies posting strong quarterly results or positive sales outlooks attracting investor interest.

Metal & Mining: The Nifty Metal index experienced some profit booking after a period of strong gains. Concerns over slowing global growth, particularly in China, a major consumer of industrial metals, weighed on sentiment. While domestic demand remains strong due to government infrastructure spending, the global demand picture remains a key concern for the sector’s near-term outlook.

FMCG Sector: The Fast-Moving Consumer Goods (FMCG) sector was subdued. Despite a strong rural focus in the Union Budget, companies in this sector are facing challenges from high inflation and cautious consumer spending. While long-term prospects remain positive, the short-term outlook is muted as companies navigate volatile raw material prices and competitive pressures.

Top Gainers & Losers

The market’s momentum was clearly visible in the list of top performers. Leading the charge were the IT heavyweights, validating the sector’s positive sentiment.

Top Gainers

Infosys: The stock surged by over 4%, contributing the most to the Nifty IT index’s gains. The company’s strong deal pipeline and positive commentary from management on a rebound in global IT spending drove investor confidence.

Wipro: Wipro’s shares saw a sharp uptick of nearly 3.5%. The company’s renewed focus on artificial intelligence and its strategic acquisitions in key markets have been well-received by analysts.

Tech Mahindra: The stock climbed over 3%. Strong order book wins and optimism surrounding the telecommunications and 5G deployment cycle contributed to the gains.

Tata Consultancy Services (TCS): Although not the top gainer on a percentage basis, TCS’s rise was significant, as it remains a bellwether for the entire sector.

Kotak Mahindra Bank: The private lender’s stock was a notable gainer in the banking space, driven by its strong asset quality and consistent performance.

Top Losers

Tata Steel: The stock faced pressure from weakening global metal prices and concerns over a slowdown in the Chinese economy.

Hindustan Unilever (HUL): HUL’s shares were under pressure as investors worried about the impact of inflation on consumer demand, especially in rural India.

Expert Commentary

According to market analysts, the IT sector’s strong performance is a reflection of a shift in global sentiment. “The IT rally is not just about a few companies, but a broader theme of a potential bottoming out in global tech spending,” said a leading market strategist at a domestic brokerage. “After a prolonged period of caution, large enterprises are now showing a willingness to commit to long-term digital transformation projects. This is a powerful signal for India’s IT majors.” Another analyst pointed out the sector’s defensive nature and solid balance sheets as key strengths. “In a volatile market, IT stocks offer stability. Their strong cash flows and stable earnings provide a cushion against economic shocks. This makes them an attractive bet for long-term investors.”

Outlook

Looking ahead, the outlook for the Indian market remains cautiously optimistic. The IT sector is poised to maintain its momentum, provided the global economic environment does not deteriorate. A key catalyst for the sector would be any positive news from the US and European economies. For the broader market, the upcoming quarterly earnings season will be a crucial test. Companies’ commentaries on future guidance and demand trends will set the tone for the next few months. Geopolitical developments and the RBI’s monetary policy decisions will also be critical factors to watch. For now, the market’s focus remains on earnings, with the IT sector leading the way.

what This Means for Indian Retail Investors

The IT sector’s rally is a significant development for retail investors. It signals that a key pillar of the Indian economy is regaining strength. For those with a long-term investment horizon, this presents an opportunity. The key is to avoid chasing momentum and instead, focus on quality stocks with strong fundamentals and a proven track record. This is not a time for a “buy everything” approach but rather a selective one, focusing on companies that are best positioned to capitalize on the renewed global tech spending. Diversification across different sectors remains crucial to mitigate risk. A careful analysis of individual companies’ balance sheets, debt levels, and future growth prospects is more important than ever.